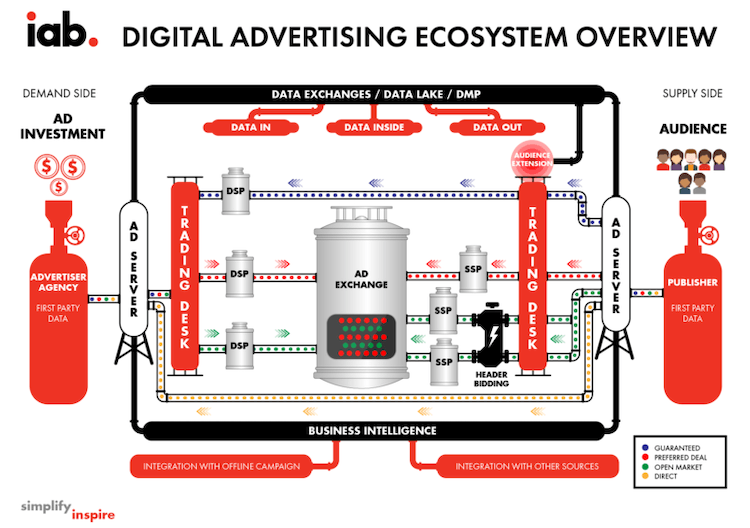

If you think back to the exact moment when you entered the world of digital advertising, you can probably remember seeing, or being shown, a diagram that looks a bit like this:

While at the time it may have seemed quite complicated, you learned it, lived it, and perhaps even grew to love it. After all, the digital advertising ecosystem is an ecosystem, and its intertwining, interdependent parts are what make it interesting. Major and minor players all have a distinct role, and the relationships between them are clear.

Correction: They were clear. What’s happening today is that despite some consolidation, the LumaScape has gotten more crowded, but more importantly, the categories have multiplied and there is far more crossover than ever before. There are no longer crystal clear distinctions between DSPs, SSPs, ad networks, etc .– especially since everyone seems to have their own definition of those terms that suits their current business development needs.

I’d like to explain what is happening, why it’s happening, and what the implications are for the industry – and not just the players that are directly involved, but the far-reaching consequences of this trend that will impact everyone, from the Fortune 500 brand advertiser to the small mobile game developer.

Ad networks becoming publishers…

AppLovin’ is the best example of this trend. While the company started in 2012 and is, at its core, a mobile marketing platform to help app developers acquire more users, its launch of Lion Studios in 2018 was a clear move into publishing. Ironsource, another ad network, mediation and UA platform, followed suit earlier this year by opening its own studio, Supersonic Games. Granted, when an ad network does this, they are essentially creating competition against their own clients, but that hasn’t seemed to have had much impact so far.

What it does do is create some obvious overlap of interests. Ironsource might not make its inventory available to AppLovin’, and vice versa. It’s similar to how Amazon Prime video works: Because they own Twitch, if you’re in that channel, you’ll see ads for Amazon Video above all else. If you’re an independent player with no conflicting interests, you still have a fair shake at that inventory.

Reason #1: The data advantage

Data is a very powerful currency overall, but within the mobile gaming space, it certainly is. As an ad network, you already have an enormous amount of data from campaigns, plus that which is passed on to you from your partners, so you get a wholesale view of the industry – and know exactly which supply to buy. And, when you are in 100% control of the content, you also get unfettered access to IAP transaction and ad conversion data. Combining ad analytics with game analytics with ad analytics means you can spot app trends very early on and back up your game ideas with numbers.

Reason #2: The arbitrage advantage

DSPs already have a mechanism for controlling which ads show, and when, but when you own the supply, you can execute on real-time ad mechanics and also use that mediation logic to corner off inventory. Rather than work with another mediator and trust that they’ll do a transparent job and the highest ad will win, if you own the supply you don’t need (or need to provide!) transparency. Furthermore, it’s fully within your rights to save the most valuable pockets for yourself (first-look) and then backfill with OpenRTB.

Still, the old model of zero transparency, where mediators could make money in ways that were invisible to publishers and advertisers, doesn’t work anymore. We are moving from a waterfall system to real-time auctions where the highest bidder simply wins under OpenRTB.

Publishers becoming advertisers…

While publishers like Netflix who only sell subscriptions use that data to create personalized experiences and to better understand what new content to create, publishers who are also advertisers can use data to figure out which types of campaigns, formats, etc. will be the most successful.

And mobile apps, where data flows are structured, are an ideal place to study, learn and iterate. There are entire companies dedicated to giving developers the optimal amount of data, and combining it with the right insights — GameRefinery’s acquisition of Reflection.io is another excellent example of the combination of gameplay data, revenue trends and insights making it easier for developers to optimize their monetization strategies.

In order to gain access to a wealth of data about users and campaign performance, some game studios have taken steps to become a DSP – or at least take on some of its characteristics.

Example: Gardenscapes

Playrix is an international developer of free-to-play mobile games that launched its first match-3 game, Fishdom: Deep Dive, in late 2015. One year later, another match-3 game, Gardenscapes, was pushed to the app stores, and a month after that, the company soon was one of the Top 20 biggest mobile game developers in the world.

By the next summer, Playrix had introduced Homescapes, another match-3 game that has very similar design and gameplay to Gardenscapes. One year later, it was in the Top 10 highest grossing publisher globally on iOS and Android.

Is the success story of an unique game studio with an incredibly talented and creative development team? No. This is a story of wash, rinse, and repeat. The company hit upon a gameplay model that worked, sure, but anyone can make a match-3 game. It was their advertising model that worked so well.

Playrix understood its Gardenscapes users – who they were and which ones were most valuable – and it used that knowledge to acquire users for its new, “lookalike” games. They went out and spent more money than anyone else in an aggressive advertising campaign that was fueled 100% by their own data, hitting all the right channels, without help from a DSP.

Anyone can do it

This model is now being followed by other types of games. Social casino, for instance, is an extremely lucrative industry, and there are at least a dozen companies that are replicating the same types of casino games over and over again.

Crazy Labs, formerly known as TabTale, now focuses on hypercasual, but for a time they were making children’s games and using their knowledge of those types of users to market new ones.

But there is still space for the middleman

In the current present (Spring 2020, for all that entails) , the digital space is booming. Specifically, ad requests sent to mobile apps are increasing rapidly. The need for advanced mediation is still strong, because not all ad networks are going to become publishers, and not all publishers are going to become DSPs.

The mobile ad industry, and mobile game development, is a science, not a guessing game. We’ve never had more signals to look at and we’ve never had more access to high-quality inventory. Moving forward over the next few years, we’re going to see more blurring of these lines, as more publishers like Gameloft and King build their own SSPs. Exciting times are coming..