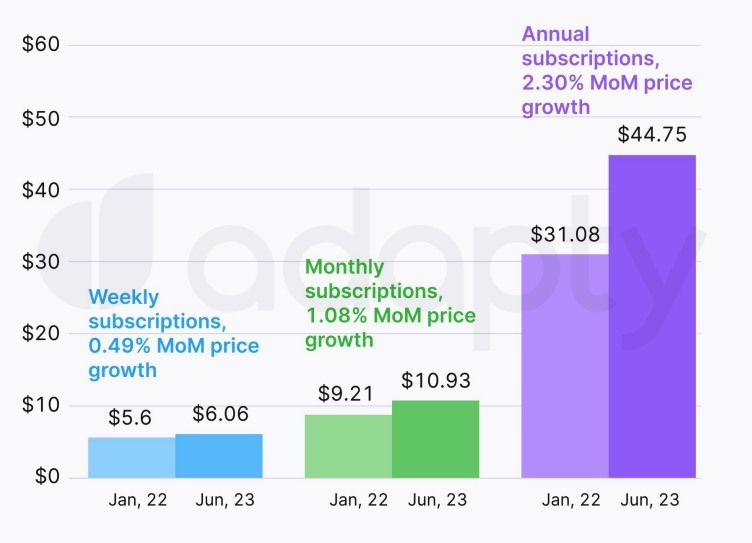

As of 2022, global economic difficulties and a rise in the inflation rate have affected the rate and pricing of in-app subscriptions. On average, there’s been a 1.29% monthly rise in mobile subscription costs, based on the latest data shared by app experts Adapty. Let’s dive into the report.

Annual subscription price hikes

A closer look at in-app subscription price changes reveals that annual prices grew 2.3% from an average $31 in January 2022 to $45 in 2023.

As the costs for advertising, attracting users, optimising app store visibility, and other forms of promotion rise, developers and publishers of apps have to change how they price their products. This is affecting overall increases in subscription prices across different levels, which is a normal reaction in the market.

Rise in in-app subscription pricing

Source: Adapty

At the same time, given price hikes, monthly subscription retention fell 10% year-on-year with the high-price segment seeing the highest churn.

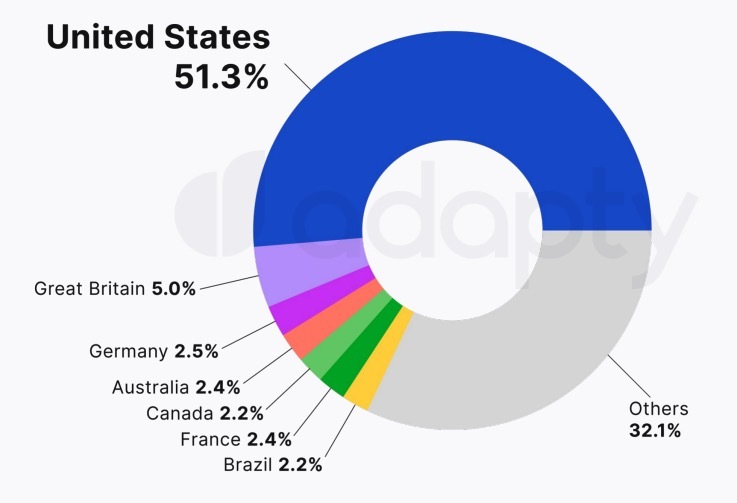

A whopping 51% of all mobile app subscriptions come from the US which shows that the country continues to lead in the mobile app subscription market, solidifying its role as the biggest and most profitable market for services based on subscriptions.

Master Global User Growth: Insights from SocialPeta's Trends White Paper

SocialPeta released the 2023 Global Mobile Games Marketing Trends White Paper, packed with the latest data and forward-looking industry insights, to empower gaming professionals to excel in the global market.

Get the ReportThis is mainly due to the country’s population that is well-versed in technology, widespread use of smartphones, and easy access to fast internet connections, all of which contribute to its ongoing superiority.

Countries dominating in-app subscriptions

Source: Adapty

Lifetime values are affected too

Another important factor in app economics is their lifetime value (LTV) which represents the average earnings generated by a customer over their entire engagement with the app. This measure helps in gauging how much one can invest in their app without the concern of expenses outweighing profits.

Weekly subscriptions had a higher LTV compared to monthly, but lower LTV compared to annual subscriptions and high-priced products had the highest LTV.

The report also noted higher trial churn during Q2 2023 indicating a drop in subscription retention.

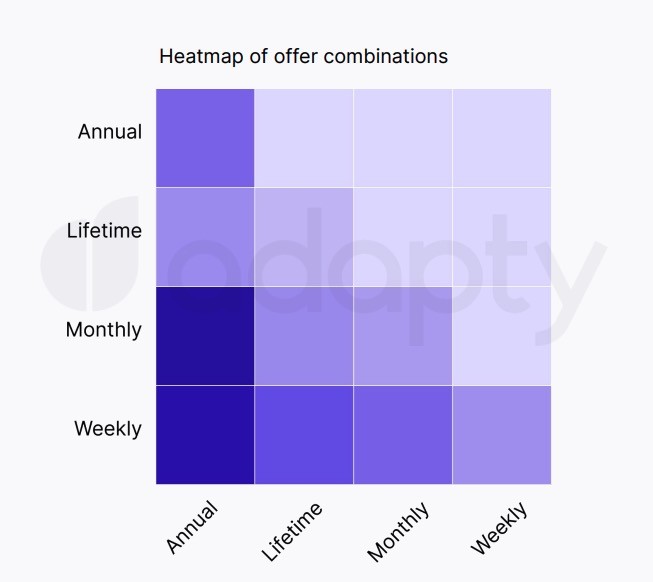

When it comes to paywalls, a combination of offering three products appears to be the most financially advantageous choice in the market. This approach assists marketers in effectively emphasising the most appealing price for the suitable subscription product, especially when contrasted with the other two options.

The one-product paywall appears to be the least appealing to users. This might suggest that customers prefer having options and feeling that they’re making an important choice, or it could be a result of price anchoring working as intended.

Key takeaways

- Annual subscription prices grew 2.3% ($31 to $45) in 2022-2023, impacting pricing trends

- US holds 51% of app subscriptions, reaffirming market dominance

- Optimal: 3-product paywall; high-priced products show highest LTV