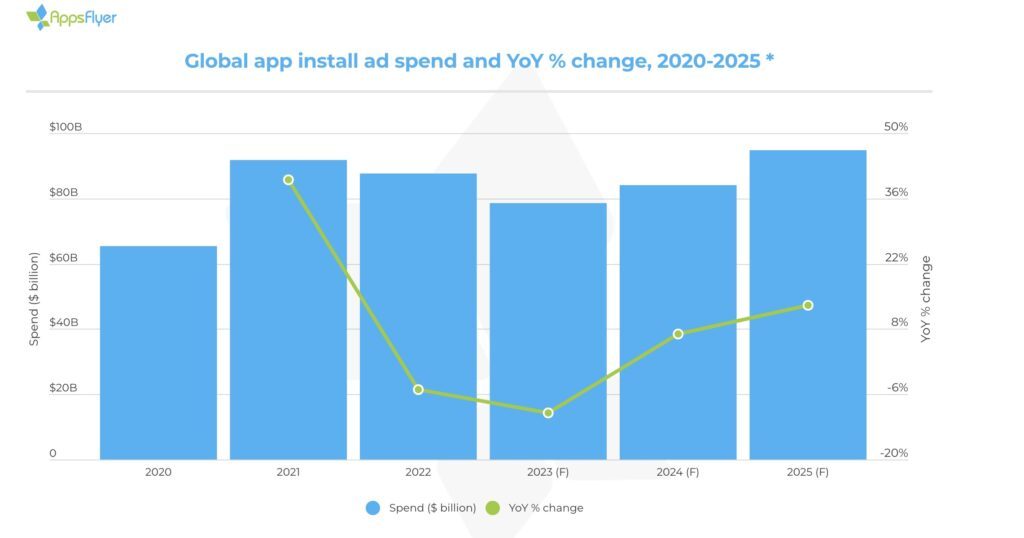

Global app install ad spend, which refers to the expenditure made by mobile apps to attract new users and encourage them to install their apps, is estimated to reach $94.9 billion by 2025. That’s according to the latest report from mobile app experts AppsFlyer.

Market fluctuations

The projected rise indicates a significant 20% growth compared to the figures recorded in 2023.

But it’s important to note that ad spending in this sector is expected to experience notable fluctuations due to the current economic downturn and the subsequent anticipated recovery.

Changes in global app install ad spending

Source: AppsFlyer

Between 2021 and 2023, AppsFlyer projects a decline of 15% in ad spending. However, starting from 2023, the forecast predicts a substantial 20% surge in ad spending by 2025. These fluctuations reflect the dynamic nature of the market influenced by economic conditions and recovery trends.

Turn installs into active and engaged customers

Grow in-app revenue and build user loyalty with custom retargeting and churn prediction campaigns from Adikteev.

Get startedInfluential factors

The mobile app marketing landscape saw significant and unprecedented changes recently. Apple’s App Tracking Transparency (ATT) framework, introduced in April 2021, no doubt, had a profound impact on marketers’ ability to measure and optimise campaigns. This shift towards aggregate data instead of user-level data optimisation has prompted the emergence of alternative measurement solutions. However, the industry has yet to fully recover to pre-ATT levels.

Add to that the Covid-19 pandemic which drove rapid digital acceleration with lockdowns and social distancing measures. Mobile apps capitalised on this by running aggressive user acquisition campaigns, particularly in the gaming sector. However, contrary to expectations, digital usage eventually cooled down and returned to pre-pandemic levels.

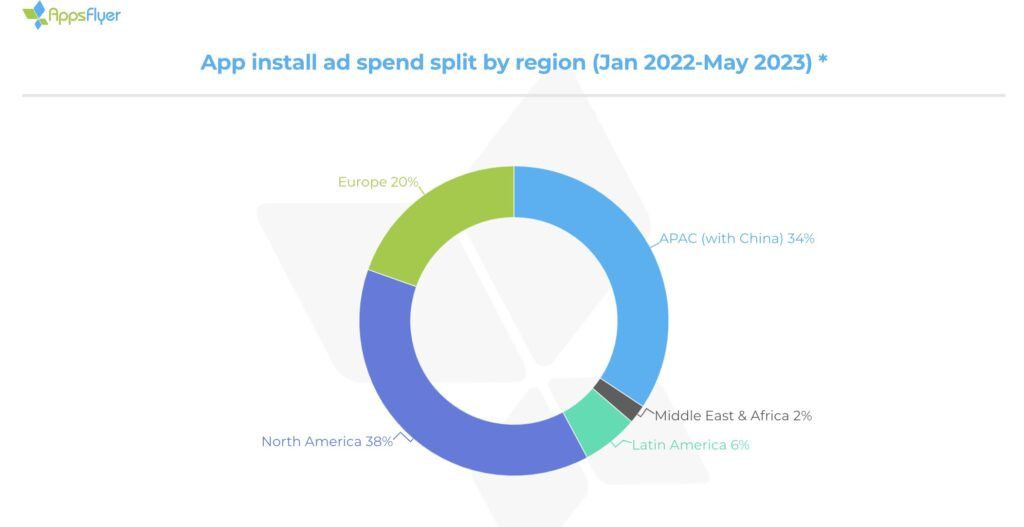

App install ad spending by region

Source: AppsFlyer

Furthermore, the global economic downturn and rising inflation rates in 2022 affected mobile businesses. Consumer-facing B2C mobile apps reduced marketing budgets and even downsized staff. The war in Ukraine added another shock to the global economy, particularly impacting energy and food markets in Europe, causing supply constraints and price hikes.

These developments have brought about significant volatility.

AppsFlyer’s data for the first five months of 2023 compared to the same period in 2022 indicates a 20% decline. Considering the ongoing recession and the projections of financial analysts, a further 6% decrease in ad spending is forecast for this year.

Toward privacy

In addition to the projected economic recovery, advancements in privacy-enhancing technology and measurement solutions are playing a crucial role in impacting ad budgets. Many apps and media sources have also adapted to Apple’s SKAdNetwork and continue to invest in the platform due to the high quality of its user base, despite the data restrictions.

Looking ahead, the adoption of SKAdNetwork 4.0, along with subsequent releases and enhancements like SKAN 5.0, is expected to reach critical mass. These updates bring significant upgrades to measurement capabilities, further empowering marketers.

Another significant development on the horizon is Google’s planned release of Privacy Sandbox for Android in 2024, which is anticipated to be smoother than Apple’s privacy changes and is likely to provide marketers with substantial visibility into campaign performance for both user acquisition and remarketing.

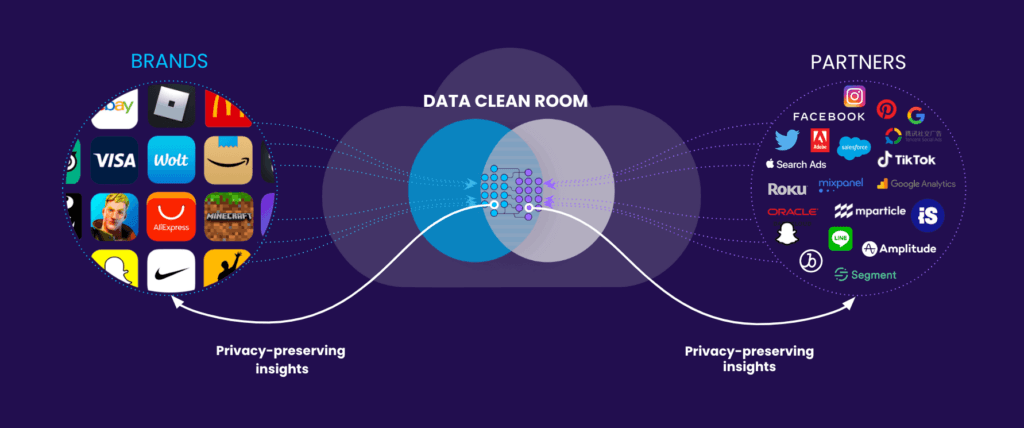

Data clean rooms

Source: AppsFlyer

Among the notable privacy-enhancing technologies, data clean rooms stand out. These secure environments enable the processing and management of sensitive data in a privacy-compliant manner, ensuring its appropriate usage.

Marketers face pressure to meet the growing demand for smartphones, particularly in developing countries, where a 13% increase in smartphone usage is projected between 2022 and 2025. This demand requires marketers to demonstrate continuous growth and adapt to evolving market dynamics.

Key takeaways

- App install ad spend is projected to reach $94.9B by 2025, with fluctuations due to the economy and privacy changes.

- Privacy-enhancing technology and measurement solutions impact ad budgets

- Marketers face pressure to meet smartphone demand in developing countries