Mary Meeker just delivered her highly-anticipated annual Internet Trends Report for the Code Conference gathering in California. Her 333 slide report covers everything from e-commerce and advertising, to data growth, freemium business models, and, finally the closing of the “Mary Meeker Gap”. Meeker places an increasing focus on the gaming industry, yet another example of the increasing importance of the gaming vertical in the wider context of the consumer engagement and behavior. Below we break down three topics she covers in her report and what they mean for advertisers today.

Games are the new social networks

According to Meeker, “interactive gaming is an increasingly relevant way to communicate”. Meeker defines interactive gamers as anyone who has played a game on a console, PC, or mobile platform in the past year. She even goes as far as calling interactive gaming the new social network – citing stats that point to a decline in social media usage year-on-year, while gaming experiences strong growth.

This statement could very well work towards combating brand hesitancy around in-game inventory. Traditionally, brands have viewed gamers as a small and specific subset of the population that is more often than not young and male, with little to no disposable income. This couldn’t be further from the truth. One-third of all gamers are over the age of 45, and 66% of mobile gamers influence the purchasing behavior of those around them.

In fact, a Newzoo study on the mobile gaming ecosystem found that 1 in 2 mobile app users has opened a game on their phone in the last seven days, making gaming the third most popular app category (tied with music) after social media and shopping apps. Although gaming isn’t the #1 most popular app category, it is the category that takes the lion’s share in terms of time spent in-app. The time spent in mobile gaming is 3.6X greater than the next largest category – entertainment.

Statistics like these continue to testify to the demographic reach and diversity of the gaming audience, and where people are choosing to spend their time, shattering traditional stereotypes of gamers and slowly chipping away at brand resistance towards in-app and in-game advertising.

The vanguard for innovation

The mobile gaming landscape has long served as the vanguard for innovation within the mobile ecosystem. In her presentation, Meeker explains that the freemium business model evolved out of the mobile gaming space, and is now utilized at both the enterprise level, through companies like G-Suite, Wix, and Dropbox, and in consumer-facing platforms, like Spotify, Canva and Amazon Prime.

Not only were mobile games the first to leverage the freemium model, but they were also the first to design their user experience with ad monetization in mind, as opposed to layering ads on top. Ads in games are most often an integral part of the app experience and the in-app economy, achieving a truly native feel. They are opt-in and offer users a clear value exchange, meaning they not only elicit engagement but also create positive advertising experiences that consistently deliver almost 100% viewability.

The nature of the in-game mobile environment has therefore necessitated the development of an advertising context that doesn’t exist anywhere else in the digital space (or for that matter on TV or out-of-home advertising), and in the context of banner blindness, ad blocking and ad skipping, advertisers are increasingly paying closer attention to this emerging medium.

The gap has closed

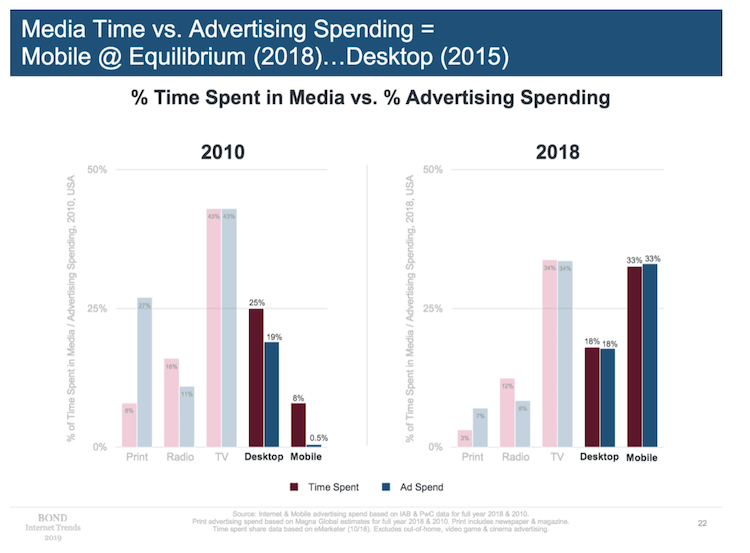

As always, our attention is drawn to Meeker’s slide where she compares advertising spend and time-spent in media. In previous years, there has been a gap between where advertisers are spending (desktop) and where internet users are consuming (mobile) – otherwise known as the Mary Meeker Gap. In 2010, when Meeker first discussed the gap – or what she referred to as the “global opportunity” – it was valued at approximately $50B. However, this year, Meeker announced that the two have finally aligned.

The closing of Meeker’s gap should hardly come as a surprise. The rise in mobile and in-app advertising spend is due to continued innovation – with the mobile medium supporting ad units that are becoming increasingly sophisticated, interactive, and engaging. Once again, gaming is at the forefront. The advent of playable ads has given performance advertisers the ability to create rich, multi-touchpoint ads that in some cases users choose to engage with again and again. In turn, these interactive ads generate a wealth of in-ad data beyond what desktop could offer, since there is an entire realm of insights available between the impression and the click.

Advertisers are able to run creative optimization that goes beyond changing CTAs or button colors, and instead treats the ad like an experience unto itself, with a beginning, middle and end which can be optimized for maximum user engagement. In this sense, the game industry represents an environment where data and creative are truly working together for the first time.

While the rising popularity of interactive ads on mobile is not solely responsible for the closing of the gap, they are grabbing an increasing share of spend from performance advertisers, and brand advertisers looking to leverage the full power afforded by the mobile in-app environment would be wise to pay more attention to the playable ads games have pioneered.

Wrapping up

This year’s Internet Trends Report highlights the potential the game industry offers for companies looking to engage with consumers where they are spending their time and in the most impactful and non-disruptive way. With more tech giants getting into the gaming space (see latest announcements from Google, Apple, Microsoft) and more of your average consumers starting to play games, we can expect the game industry to gain an increasing share of voice in Meeker’s report (and the wider technology conversation) in the coming years.