Brand spending in private marketplaces (PMPs) will overtake spending in real-time open auctions for the first time next year, according to eMarketer’s latest forecast. As with so many other broader digital advertising trends, we’re also seeing this tendency toward PMPs expand to the in-app advertising marketplace—a shift we expect will only accelerate.

Given the unique nature of in-app environments, we are seeing interesting nuances emerge when it comes to the verticals investing most heavily in in-app PMPs, as well as the premiums they’re willing to pay. Let’s take a look at what the latest data tells us about emerging advertiser in-app spending patterns, as well as what this shift means for premium in-app publishers.

The PMP Advertiser Attraction

Brands across all verticals have started turning to PMPs due in large part to the quality and brand safety concerns that have plagued open exchange buying in recent years. That said, while PMPs are already set to overtake open auctions across the open web, ad spending via open auction still constitutes the majority of total ad spending on the Smaato platform and will for years to come. The gap is narrowing, though—and the growth rate of PMP spending is impressive.

According to eMarketer, U.S. advertisers will spend $12.22 billion on open exchanges and $11.56 billion on PMPs in 2019. That represents a year-over-year growth rate of 9.4 percent and 21.6 percent, respectively. Meanwhile, on the Smaato platform in the first half of 2019, in-app ad spending via PMPs rose 250 percent compared to the year-ago period. Obviously such tremendous growth rates are indicative of a newly established swing within the in-app marketplace versus the open web, where the shift has been underway for years.

Across the board, brands have increased their focus on finding premium, protected environments where they can spend their advertising dollars. The attraction to PMPs is clear: They offer an invitation-only programmatic auction in which a premium publisher offers its inventory to a select group of buyers. Although PMPs are not as simple to use or as scalable as open auction deals, they represent a more controlled environment for accessing premium inventory.

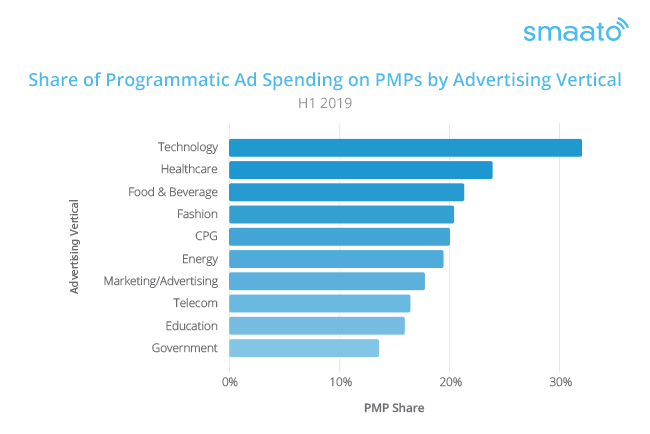

Control is especially crucial for brands that are new to the in-app arena and looking to invest their first ad dollars into this rapidly growing medium. On the Smaato platform, the advertisers spending the largest share of their in-app advertising budgets in PMPs are from the technology, healthcare, and food and beverage industries.

The Publisher Opportunity

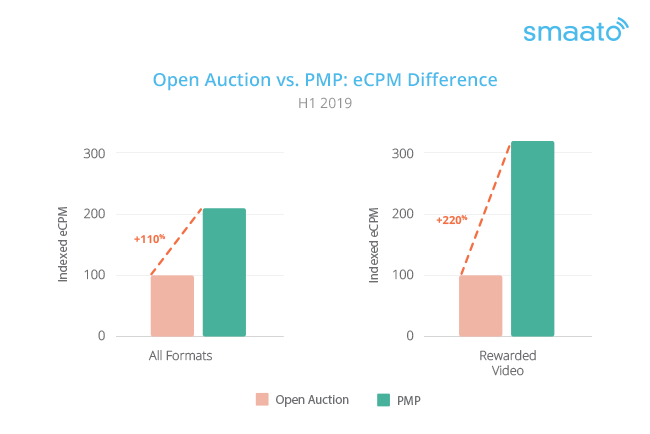

For app publishers, the shift toward PMP spending represents a significant opportunity. As brands look for exclusive access to premium inventory, they’re willing to pay for it. In fact, the average eCPM for in-app PMP deals is 110 percent higher than that of open auctions. Within formats that are unique to the in-app environment, the difference is even more notable: eCPMs for rewarded video, for example, were 220 percent higher on PMPs than the open auction. Again, because rewarded video is only available in mobile apps, it might be that PMPs provide the safety and control necessary to get traditional advertisers to test out in-app advertising for the first time.

The PMP opportunity is ripe for apps within all verticals, but some are already taking greater advantage than others. On the Smaato platform in the first half of 2019, real estate, social and dating, and sports apps saw the largest shares of ad revenue coming from PMP deals when compared to other app categories. The most likely reason? Data. Notably, apps within these three categories tend to be rich in user data, including location insights. That makes them a particularly attractive target for advertisers looking for both control in their buys as well as highly targeted audiences.

PMPs represent a win-win scenario for brands and publishers alike. While advertisers gain the benefit of access to premium inventory, app publishers can use PMPs to identify advertisers willing to make high-eCPM deals with high-volume commitments. Given these benefits, we expect to see a greater variety of app publishers expanding their offerings into PMPs—much to the delight of their waiting advertisers.