My name is Kira Chesalina. I am the creative director at Appska, an international performance marketing agency. We run advertising campaigns based on our own strategy of working with bloggers from different parts of the world.

In this article, I want to talk about such an interesting GEO as the Gulf Region. Our agency actively works with top influencers in this region, makes creative projects and successfully promotes advertisers’ products.

I will share with you helpful information about the United Arab Emirates, Saudi Arabia, Qatar and Oman. For each of these GEOs, I will give a short country image, overview, types of content, influencer marketing trends, figures on social networks and so on.

I’m sure this information will help you build the right Influencer Marketing strategy in these GEOs.

But first, take a quick look at what’s trending in the Gulf region as a whole:

- Shows for Netflix

- Ramadan campaigns

- Smart cities

- Rise of football

And now the details. Let’s get started!

The United Arab Emirates

Country Image

- Expensive cars, sheikhs, Gym rats, startups

- Population: 9.52M

Overview

- 10M social media users in January 2023, equating to 105% of the total population.

- Social media users by gender: 69.6% – male, 30.4% – female.

- Following the successful staging of Expo 2020 in Dubai and the 2022 World Cup, an increasing number of brands across the Middle East are turning to YouTube to connect with potential holiday-goers seeking travel tips, discovering new destinations, and seeking entertainment. Searches for such a destination as Dubai have increased by up to 74% over the past year.

- Mobile watch time of videos in the UAE is one of the fastest growing in the world, rising by 120% year on year (2014-2015), faster than the global average.

- There is an insatiable appetite among people for good content, and they are willing to invest their time in watching longer videos. That’s why marketers took advantage of the reach and longer time frames on YouTube to tell stories to strong effect.

- Creativity is a big driver of ROI for ad campaigns. Research by Analytics Partners shows that a good creative asset can drive 62% of video and display ROI.

The most popular bloggers from the UAE create content on the following topics:

- Lifestyle

- Parenting and family

- Fashion and accessories

- Beauty

- Art

- Comics

- Food

- Technological products

- Interviews with celebrities, athletes, entrepreneurs

- Entertainment

- Humor and memes

- Everyday life in the UAE

- Expensive cars and luxurious lifestyle

Trends

Trend #1. Podcasts

There is a growing inclination among people to engage in conversations, driven by the fact that everyone holds opinions and desires to express them. This trend is not limited to individuals or professionals alone; even brands are actively venturing into the realm of podcasting. The audience in the UAE is well acquainted with this concept and has shown a positive response.

Trend #2. Twitter spaces

Twitter spaces have become a preferred platform for businesses to host conferences, virtual events, and discussion sessions. In the UAE, people are eager to establish connections with the individuals behind their beloved brands. It hasn’t yet been used creatively in various verticals – though individuals are using it much more diversely than brands so there is much more space for experiments.

Trend #3. Marketing tool for small businesses

Social media has become the primary marketing and advertising tool for small and home-based businesses, presenting a competition that no business or enterprise can afford to overlook. These businesses create distinctive content, engage with influencers, establish Instagram shops, and utilize platforms like WhatsApp or other messengers to receive orders and offer customer service.

Trend #4. Reels

Instagram reels and TikTok videos are on the rise when it comes to viral social media marketing, and they are here to stay.

Figures

- 7.3M users in early 2023

- Potential ad reach increased by 100K (+1.4%) between 2022 and 2023

- Ad reach was equivalent to 77% of the total population at the start of 2023

- 73.1% – male, 26.9% – female

- 6.6M users in early 2023

- Potential ad reach increased by 900K (+15.5%) between 2022 and 2023

- The size of the ad audience increased by 300K (+4.8%) between October 2022 and January 2023

YouTube

- 8.99M users in early 2023

- Ad reach was equivalent to 94.8% of the total population in early 2023

- Potential ad reach decreased by 70K (-0.8%) between the start of 2022 and early 2023

- 72% – male, 28% – female

TikTok

- 8.23M users 18+ in early 2023

- Ads reached 105% of the audience 18+ at the start of 2023

- Ad reach was equivalent to 87.7% of the local internet user base (regardless of age) at the start of 2023

- 74.2% – male, 25.8% – female

- 4.95M users in early 2023

- 60.3% of the audience 13+ uses Instagram in 2023

- Ad reach at the start of 2023 was equivalent to 52.7% of the local internet user base (regardless of age)

- 64.6% – male, 35.4% – female

Snapchat

- 4M users in early 2023

- Potential ad reach increased by 750K (+23.1%) between the start of 2022 and early 2023

- 55.5% – male, 43.9% – female

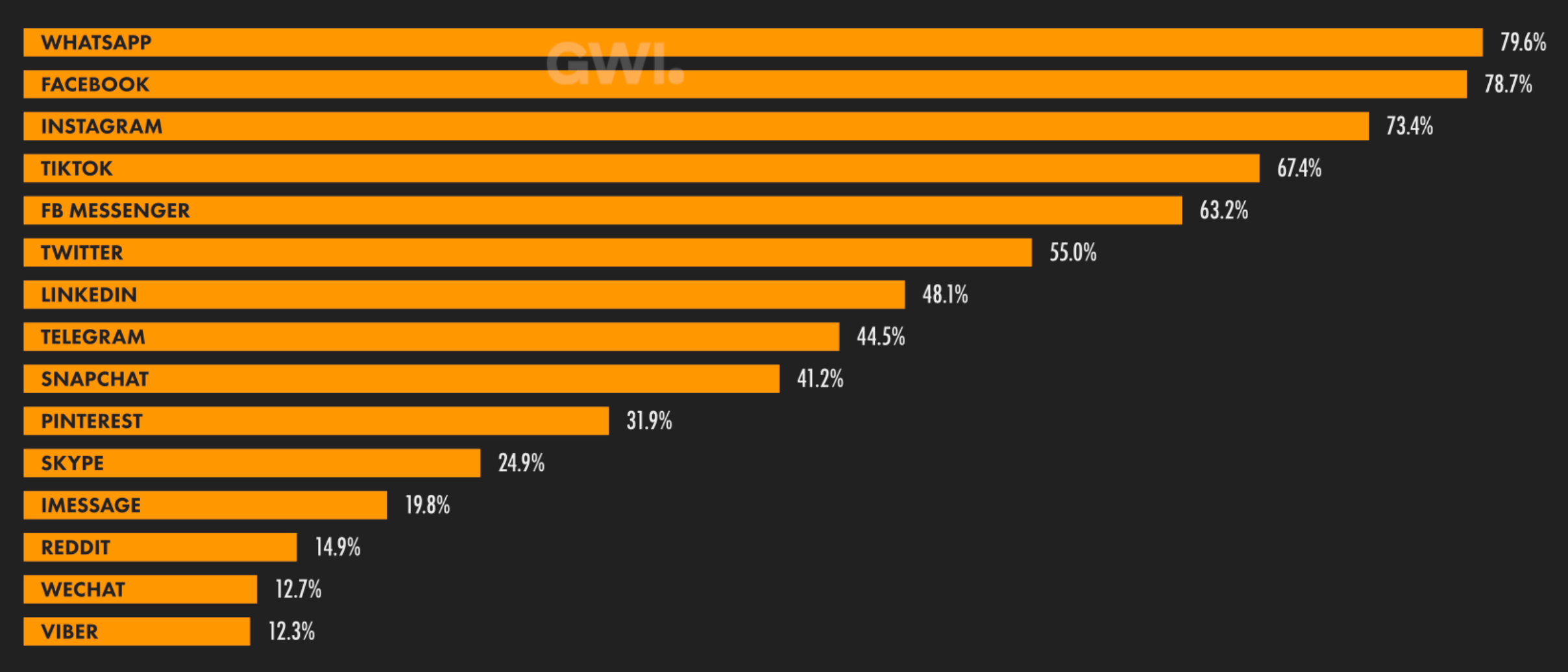

Most used social media platforms

Internet users 16-64 who use each platform each month

Source: Meltwater and We Are Social

- * GWI Survey

- ** YouTube didn’t offer the answer, so it does not appear in this ranking

Saudi Arabia

Country Image

- Gen Z, fast delivery, Ramadan campaigns, travel

- Population: 36.7M

Overview

- 29.1M social media users in Saudi Arabia in January 2023 (79.3% of the total population).

- Social media users by gender: 63.1% – male, 36.9% – female.

- Instagram influencer marketing in Saudi Arabia has experienced remarkable growth in recent years, propelled by a series of social and cultural events that have paved the way for the kingdom’s integration with the global community.

- In alignment with the ‘Saudi Vision 2030’ plan aimed at diversifying the economy, numerous brands have established their regional headquarters within the kingdom.

- Since 2019, individuals can apply for tourist visas to enter the country for leisure purposes and to experience the culture.

- Saudi Arabia has experienced a significant surge in the development of hotels, entertainment venues, and Saudi social media influencers looking to change the world’s view of the kingdom. These influencers have seized the opportunity to collaborate with international brands seeking to enter the market by delivering culturally resonant messages and relatable content.

- In 2022, 80% of individuals between the ages of 17 and 38 frequently engaged in online shopping in the Middle East.

- With Saudi Arabia projected to become the largest market in the MENA (Middle East and North Africa) region, businesses must take the initiative to harness their power at this pivotal stage.

The most popular bloggers from Saudi Arabia create content on the following topics:

- Lifestyle

- Food

- Beauty

- Fashion

- Humor

- Entertainment

- Games

Trends

Trend #1. Buy now – pay later

Tabby’s launch in 2019 played a crucial role in enhancing the accessibility of online shopping for one million users in the UAE and Saudi Arabia. In Saudi Arabia specifically, buy-now-pay-later methods accounted for 55% of online purchases in 2021. The popularity of deferred payments is expected to skyrocket in the upcoming years, creating a significant opportunity for businesses to adjust and broaden their digital payment choices to attract Gen Z and millennial shoppers.

Trend #2. Quick delivery

The surge in instant delivery services in Saudi Arabia has experienced remarkable growth, catering to customers’ desire for immediate satisfaction and setting higher standards for delivery times. Platforms such as Instashop, which ensures delivery within an hour, and Amazon Same-Day Delivery have served as inspirations for numerous brands in the region, prompting them to prioritize the demands of their customers in this way.

Trend #3. Gen Z and millennials are game-changers

Mainstream influencers and celebrities have become less influential among Gen Z and millennials, who now gravitate towards genuine creators who actively engage with their audience and share relatable and trustworthy content. When it comes to online shopping, these demographics take their time to convert and rely more on recommendations from family, friends, blogs, and reviews. Saudi businesses can foster a meaningful connection with Gen Z by utilizing micro-influencers to cultivate an authentic community among their followers and deliver credible content. Gen Z is inclined to support something they feel a genuine connection to.

Trend #4. The significance of TikTok and YouTube

The influence of social media reached new heights during the pandemic, with the Middle East experiencing a staggering 93% surge in social media shoppers. The emergence of short-form video platforms like TikTok played a significant role in reshaping customer interactions with brands and their purchasing behaviors. While short-form videos primarily resonate with the Gen Z market, millennials constitute the largest audience on YouTube. Saudi users, in particular, have demonstrated themselves to be the most dedicated viewers globally, spending approximately one hour each day consuming video content on the platform.

Figures

- 10.75M users in early 2023

- Potential ad reach decreased by 650K (-5.7%) between 2022 and 2023

- Ad reach was equivalent to 29.3% of the total population at the start of 2023

- 78% – male, 22% – female

- 7.3M users in early 2023

- Potential ad reach increased by 1.2M (+19.7%) between 2022 and 2023

- The size of the ad audience increased by 300K (+4.3%) between October 2022 and January 2023

- 77.4% – male, 22.6% – female

YouTube

- 29.1M users in early 2023

- Ad reach was equivalent to 79.3% of the total population in early 2023

- 60.1% – male, 39.9% – female

TikTok

- 26.39M users 18+ in early 2023

- Ads reached 103% of the audience 18+ at the start of 2023

- Ad reach was equivalent to 72.7% of the local internet user base (regardless of age) at the start of 2023

- Potential ad reach increased by 4M (+18%) between the start of 2022 and early 2023

- 65.8% – male, 34.2% – female

- 12.45M users in early 2023

- Ad reach at the start of 2023 was equivalent to 33.9% of the total population

- Potential ad reach decreased by 3M (-19.4%) between 2022 and 2023

- 57.9% – male, 42.1% – female

Snapchat

- 21.15M users in early 2023

- Ad reach was equivalent to 57.7% of the total population at the start of the year

- Potential ad reach increased by 950K (+4.7%) between the start of 2022 and early 2023

- 52% – male, 48% – female

- 15.5M users in early 2023

- Ad reach was equivalent to 42.3% of the total population in early 2023

- Potential ad reach increased by 1.4Ь (+9.9%) between the start of 2022 and early 2023

- 60% – male, 40% – female

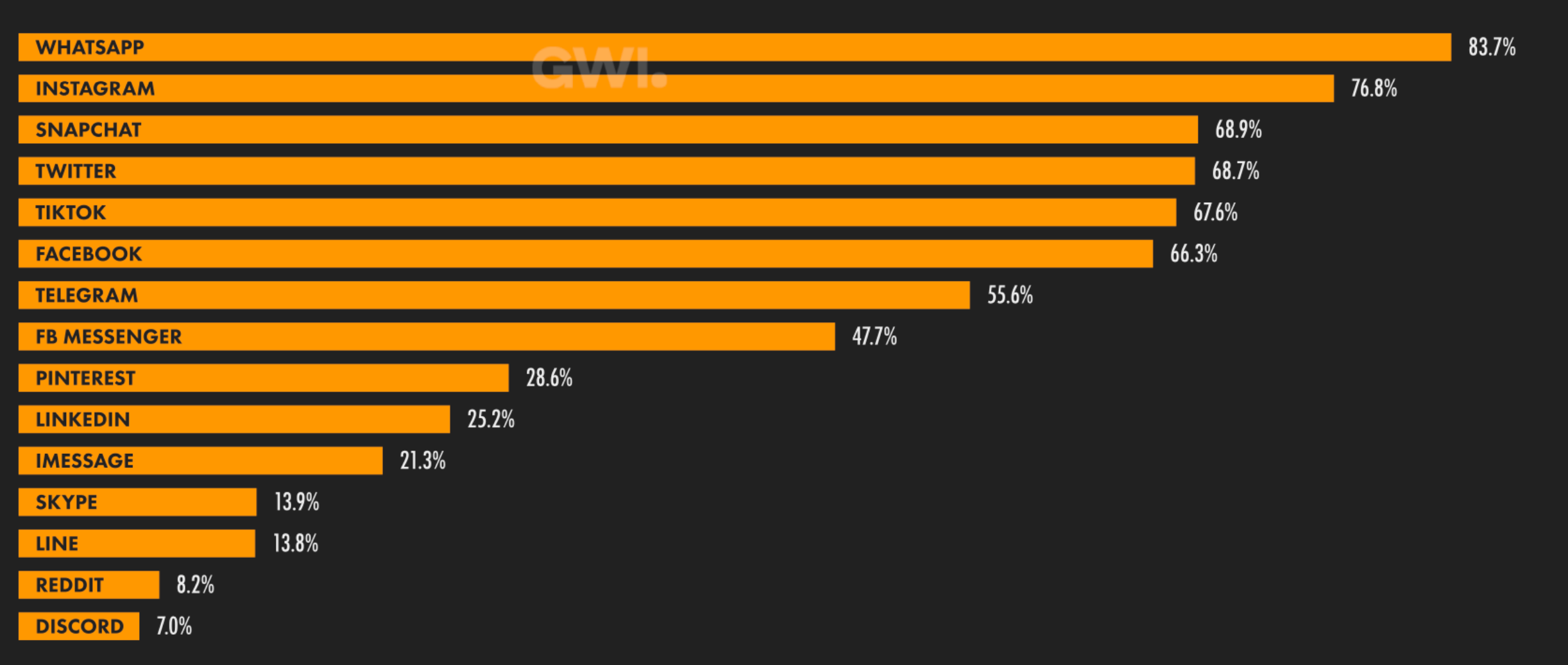

Most used social media platforms

Internet users 16-64 who use each platform each month

Source: Meltwater and We Are Social

- * GWI Survey

- ** YouTube didn’t offer the answer, so it is not appear in this ranking

Qatar

Country Image

- Football, cooking, comedy, family

- Population: 2.7M

Overview

- 2.62M social media users in January 2023, equating to 96.8% of the total population.

- Qatar stands tall with one of the highest GDP per capita figures globally, reaching $93.5 billion in 2021, as reported by the World Bank’s data on purchasing power parity (PPP). This achievement positions Qatar as the fourth-ranked country worldwide in terms of PPP. Boasting exceptional facilities, modern infrastructure, and a harmonious blend of local traditions and cosmopolitan influences, Qatar emerges as one of the most vibrant and dynamic countries in the region.

- With an investment of over $200 billion, Qatar has taken significant strides towards enhancing its infrastructure, expanding the North gas field, preparing to host the 2030 Asian Games, and implementing initiatives aimed at diversifying the economy beyond hydrocarbons. These endeavors have bolstered Qatar’s standing as a highly promising investment destination.

The most popular bloggers from Qatar create content on the following topics:

- Life in Qatar

- Humor

- Football

- Tech news

- Games

Figures

- 1.95M users in early 2023

- 83.6% of the audience 13+ uses Facebook in 2023

- Ad reach was equivalent to 72.1% of the total population at the start of 2023

- 75.5% – male, 24.5% – female

- 1.2M users in early 2023

- 54.1% of the audience 18+ uses LinkedIn in 2023

- Ad reach was equivalent to 44.3% of the total population at the start of 2023

- Potential ad reach increased by 200K (+20%) between 2022 and 2023

- 73.7% – male, 26.3% – female

YouTube

- 2.62M users in early 2023

- Ad reach was equivalent to 96.8% of the total population at the start of the year

- 78.6% – male, 21.4% – female

TikTok

- 2.14M users 18+ in early 2023

- Ad reach was equivalent to 96.5% of the audience 18+ at the start of 2023

- Ad reach was equivalent to 79.9% of the local internet user base at the beginning of the year (regardless of age)

- Potential ad reach increased by 602K (+39.1%) between the start of 2022 and early 2023

- 75.9% – male, 24.1% – female

- 1.1M users in early 2023

- Ad reach was equivalent to 40.7% of the total population at the start of the year

- 47.2% of the audience 13+ uses Instagram in 2023

- Ad reach at the start of 2023 was equivalent to 41.1% of the local internet user base (regardless of age)

- 65.4% – male, 34.6% – female

Snapchat

- 975K users in early 2023

- 41.8% of the audience 13+ in Qatar uses Snapchat in 2023

- Ad reach was equivalent to 36.4% of the local internet user base (regardless of age) at the start of the year

- Potential ad reach increased by 240K (+32.7%) between the start of 2022 and early 2023

- 57.1% – male, 42.3% – female

- 1.05M users in early 2023

- 45% of the audience 13+ uses Twitter in 2023

- Ad reach was equivalent to 39.2% of the local internet user base (regardless of age) at the start of the year

- Potential ad reach increased by 431K (+69.7%) between the start of 2022 and early 2023

- 71.4% – male, 28.6% – female

Oman

Country Image

- TikTok, women’s power, kids entertainment

- Population: 4.6M

Overview

- 4.17M social media users in January 2023, equating to 90.5% of the total population.

- 93.8% of Oman’s total internet user base (regardless of age) used at least one social media platform in January 2023.

- Social media users by gender: 69.6% – male, 30.4% female.

The most popular bloggers from Oman create content on the following topics:

- Lifestyle

- Fashion

- Beauty

- Movies

- News

- Entertainment

- Travel

Trends

Trend #1. TikTok growth

TikTok has charmed the youth of Oman, captivating them with popular trends and charismatic TikTok influencers. While it initially served as a source of entertainment for some, it has transformed the lives of many. But what sets this platform apart, making it so irresistible and distinctive? The answer lies within the talented community of content creators. With its rise in popularity, TikTok has nurtured a vibrant community of local influencers who now reign in the TikTok realm of Oman. Among scores of those hooked on this new trend, there are four noteworthy TikTokers in Oman who have doubled the number of their followers over the past two years.

Trend #2. CPM model

The CPM model takes precedence over others in Oman. It is extensively employed in Social Media Advertising, where advertisers pay for every thousand clicks (Cost per Mile). The Oman Digital Marketing Market is expected to experience significant growth in terms of advertising spending during the reviewed period of 2018-2023, with a projected compound annual growth rate (CAGR) of approximately 7% with robust support enlarged from Hospitality and Tourism and BFSI (Banking, Financial Services, and Insurance) segments.

Figures

- 1.2M users in early 2023

- Ad reach was equivalent to 26% of the total population at the start of 2023

- 78.1% – male, 21.9% – female

- 790K users in early 2023

- LinkedIn’s audience was equivalent to 17.1% of the total population at the start of 2023

- 24.7% of the audience 18+ uses LinkedIn in 2023

- Potential ad reach increased by 100K (+14.5%) between 2022 and 2023

- 72.1% – male, 27.9% – female

YouTube

- 4.17M users in early 2023

- Ad reach in early 2023 was equivalent to 90.5% of Oman’s total population

- 69.6% – male, 30.4% – female

TikTok

- 1.73M users 18+ in early 2023

- Ad reach was equivalent to 54.2% of all adults 18+ at the start of 2023

- Ad reach was equivalent to 39% of the local internet user base at the beginning of the year (regardless of age)

- Potential ad reach increased by 221K (+14.6%) between the start of 2022 and early 2023

- 72.5% – male, 27.5% – female

- 1.75M users in early 2023

- Ad reach was equivalent to 38% of the total population at the start of the year

- 66.5% – male, 33.5% – female

- 990K users in early 2023

- 28.3% of the audience 13+ uses Twitter in 2023

- Ad reach was equivalent to 22.3% of the local internet user base (regardless of age) at the start of the year

- Potential ad reach increased by 126K (+14.6%) between the start of 2022 and early 2023

- 62.8% – male, 37.2% – female

Snapchat

- 1.75M users in early 2023

- Ad reach was equivalent to 38% of the total population at the start of the year

- Potential ad reach increased by 200K (+12.9%) between the start of 2022 and early 2023

- 51.7% – male, 47.8% – female

Final thoughts

I hope you have received a lot of useful information about the Gulf region, which will help you properly build your Influencer Marketing in the UAE, Saudi Arabia, Qatar and Oman.

I would also like to point out that the performance marketing agency Appska works with the top influencers in these GEOs. So, we are ready to help you promote your products on the Arab market and launch successful advertising campaigns in various formats:

- Special projects

- Events

- Streams and live broadcasts

- Draws and contests

- Creative formats

- Posts and integrations

We are waiting for you at Appska!