The Mobile Games Index report, powered by data from adjoe and Statista, is back for its fourth edition.

Last year, MGI highlighted a low point in user engagement – daily dedication to mobile games was dropping. This year, fortunately, the data shows that the length of daily sessions has rebounded, restoring monetization opportunities. Yet, the market landscape is not the same as it was a year ago.

This index benchmarks games using adjoe and Statista’s first-party data from 95 million interactions across 27 million users, shedding light on current and upcoming industry trends. With forecasts extending to 2028, this knowledge of the audience and its preferences starts a race to capitalize on these insights first.

Multiplayer titles are topping the engagement charts

Globally, “Call of Duty®: Mobile – Garena” by Garena Mobile Private leads the engagement charts with its action-packed multiplayer gameplay. Stepping on its heels is “Mobile Legends: Bang Bang” from Moonton, a game that has consistently made players clock in hours with its depth and multiplayer possibilities. Another notable mention is “Free Fire MAX” by Garena International I, which highlights the overall trend for multiplayer action dominating player engagement.

In North America, “Call of Duty: Mobile Season 1” by Activision Publishing, Inc. tops the list, aligning with the global preference for established, high-action multiplayer franchises. “Free Fire: Winterlands,” another title from Garena, also shows extreme popularity, along with “PUBG MOBILE” by Level Infinite, emphasizing the strong market for competitive shooter games in this area.

Europe shows a slightly different preference with “Brawl Stars” by Supercell leading. This is followed by “Survivor.io” and “Roblox”, making for a mix of action and adventure that resonates with European players. Yet, once again the top of the daily usage list is dominated by multiplayer experiences.

In Asia, similarly, “Mobile Legends: Bang Bang” by Moonton dominates, followed by “Call of Duty®: Mobile – Garena” and “Free Fire MAX. by Garena”

Africa and Oceania show more diversity in mobile games leading in engagement. In Africa, “Free Fire: The Chaos” leads, followed by “Car Parking Multiplayer”, which suggests a taste and market that extend beyond mainstream action games. In Oceania, “Call of Duty: Mobile Season 1” and “Roblox” top the charts, again pointing to a preference for strategy and action-packed gameplay.

In the Casual genre – which has seen the biggest growth in engagement over the year – the top spots by time spent are taken by established publishers like Outfit7 Limited with its “My Talking Tom” and “My Talking Angela” series, King with “Candy Crush”, and Playrix with “Homescapes” and “Gardenscapes”.

That’s just scratching the surface of the engagement data from the Mobile Games Index 2024 – the full version goes in-depth with extensive top lists by genre and region, allowing analysis of the preferences of all global audiences.

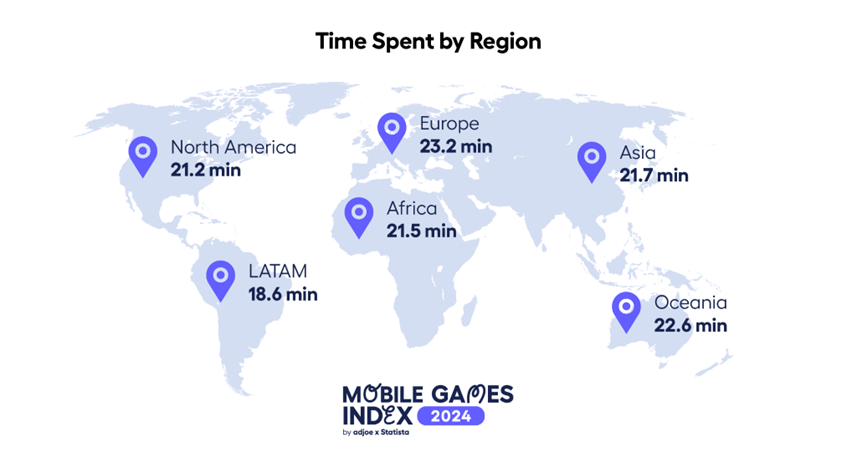

Time spent by region

Source: adjoe

Engagement trends by region – European players in the lead

The engagement patterns over the year reveal clear-cut trends of player preferences across the regions that are waiting to be used for precise UA and monetization strategies.

As the industry as a whole experiences an uplift in user activity, Europe leads in daily engagement, with players averaging 23.2 minutes on mobile games. The main driver for playtime in Europe was Adventure games, catering to the region’s high entertainment standards with engaging storytelling and deeper gaming experiences.

The dark horse of the report, the region of Oceania, is experiencing a rapid increase in engagement, with the highest climb in daily usage rates among all regions – 35% – now at 22.6 minutes per day. This substantial growth positions Oceania as an emerging market – still small, but with clear potential that could strengthen your app growth strategy. Developers and marketers should view these statistics as a promising trend and a green light for expansion.

In contrast, Latin America shows the most modest growth at 8% since last year, with an average engagement time of 18.6 minutes per day. While this increase might seem less dramatic, it suggests a market that may benefit from mobile games designed for shorter, more casual play sessions.

Changes in engagement across different demographics

The engagement trends through different demographics have changed drastically since last year.

Generally, the casual genre shows the most growth across all age groups at +41%. Adventure and board games recorded the longest average daily sessions – 26 and 25 minutes, respectively.

The 40-49 age group has emerged as the most active globally, with their engagement time increasing by 33% since last year to an average of 23 minutes per day. This age group’s preference is for Card, Board, and Casual games.

On the other hand, the previously dominant younger demographic of 0-to-19-year-olds has taken a 180-turn, performing the shortest daily mobile gaming time among all ages at 20.6 minutes on average.

If the attention of the youngest players is fleeting from mobile gaming, this finding might indicate that game developers and UA specialists may need to explore new marketing tactics or even gaming formats to recapture the engagement of the under-twenties.

What hasn’t changed over time is women’s lead in gaming engagement – it’s continuously higher than men’s, now at 21.4 minutes daily. Women have demonstrated a higher average daily usage across most genres, particularly leading in Adventure, Board, and Card games. Conversely, men have shown a preference for Strategy and Action games.

The global mobile game market is expanding

The global mobile gaming market is still on a trajectory of growth, projected to expand from $166.1 billion in 2024 to $227.0 billion by 2028, marking a compound annual growth rate of 7.28%.

Interestingly enough, the card genre is experiencing the most rapid growth, with its market size expected to nearly double by 2028, compounding an explosive 13.8% CAGR – providing ample room for experimenting and launching new projects in the genre. Similarly, board and puzzle games are also set to see major growth – the evidence is right in the MGI 2024, which suggests these genres are driving some of the biggest engagement across regions.

The MGI 2024 clearly underscores that genre preferences vary from region to region – from RPGs in Asia to Strategy and Casual games in North America – highlighting the need for targeted marketing and game development strategies. With these insights, it is now possible to capitalize on specific market dynamics and tailor offerings to meet the preferences of global audiences.

How will you adapt your strategy?

Now that the insights are out, it’s up to you how to take action. The complete report goes granular allowing you to benchmark your projects against the expectations of each genre’s players and the best-performing titles across geos.

Data is power, and these insights can be the competitive edge you need to win over the desired audiences.

Access the full Mobile Games Index 2024 report for free here.