In the ever-evolving mobile app landscape, it’s crucial to stay on top of the latest trends and shifts in user behaviour. A recent report from Sensor Tower sheds light on some interesting developments in the world of mobile apps in early 2023. While global game revenue remained weak year over year at the beginning of the year, spending on non-game apps reached a record high in January 2023, largely driven by entertainment apps.

Emerging markets lead the way

Despite the initial surge caused by the outbreak of COVID-19, global mobile downloads have since decelerated, although they have remained well above pre-pandemic levels. In 2022, the U.S. and emerging markets such as India, Brazil, and Indonesia led the way in mobile adoption, with Europe accounting for nearly 19% of global downloads. However, in recent years, Europe’s share has declined in favour of emerging markets.

While China may soon see a push in adoption due to the easing of tech crackdown and the end of its zero-COVID policy, Africa is expected to drive relative growth in the medium term. Although African countries are currently outside the top 20 markets by installs, they are poised to rise in global download rankings in the next few years due to a young and rapidly growing population, as well as some of the fastest-growing smartphone penetration rates globally.

Global app installs slow but remain above pre-pandemic levels

Source: Sensor Tower

Consumers spend fewer dollars on Android

In 2022, global consumer spending on Android saw its first-ever decline, falling by 7% year over year. The drop can be attributed to a combination of rising inflation and Apple’s anti-tracking rules, which have made it increasingly challenging to target ads and measure their effectiveness. The slowdown in mobile game spending worldwide was the main driver behind the plunge in Android revenue, with Japan experiencing the largest decline among major economies.

Global Android spending falls for first time on Android

Source: Sensor Tower

With stubborn inflation and weak consumer spending, app developers are exploring new monetisation strategies. Some apps, such as Tinder and Duolingo, are diverting more resources towards promoting one-time in-app purchases, which may have taken a backseat in the past in favour of higher-value subscription services.

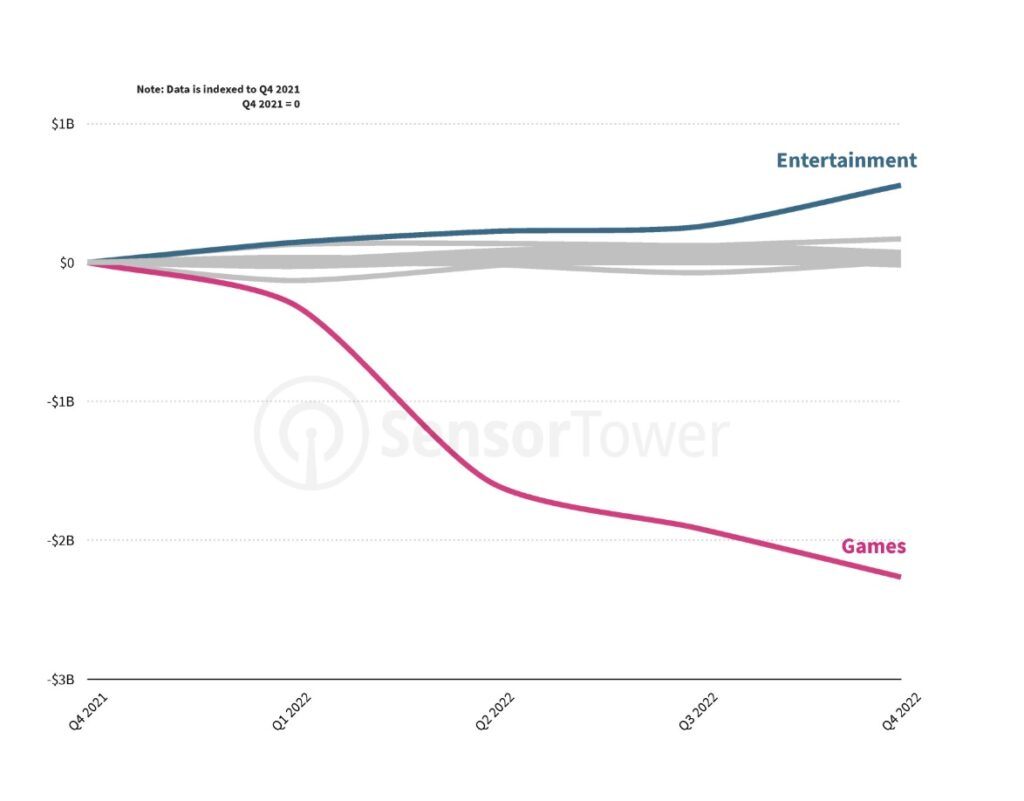

All eyes on entertainment apps

At the start of 2023, global game revenue remained weak year over year, while spending on non-game apps hit a new record in January 2023, propelled by entertainment apps. In recent quarters, the entertainment category has been rapidly expanding across various markets, with spending in the US reaching twice that of the next-largest category for the first time in 2022.

According to data from Sensor Tower’s App Overlap module, TikTok and Netflix are among the top apps that users of the world’s highest-grossing game apps, including Coin Master and Pokemon Go, are most likely to spend time on. As these boundaries between different categories of apps continue to blur, it will be interesting to see how app developers adapt to these changing user trends.

TikTok emerged as the fastest-growing ad channel across North America and major European markets. Its growing active user base, high levels of engagement, and reportedly lower advertising costs have contributed to the increasing amount of digital ad spending being allocated to the platform. Notably, TikTok was the fastest-growing app in terms of consumer spending in 2022.

However, as brands continue to slow their ad investments, apps that rely heavily on advertising are now seeking new sources of revenue. Meta, Twitter, and Snapchat are among the companies that have recently launched subscription services to diversify their revenue streams.

Key takeaways

- Africa is expected to drive relative app download growth in the medium term

- In 2022, global consumer spending on Android saw its first-ever decline, falling by 7% year over year

- The entertainment category has rapidly expanded across various markets, with spending in the US reaching twice that of the next-largest category for the first time in 2022