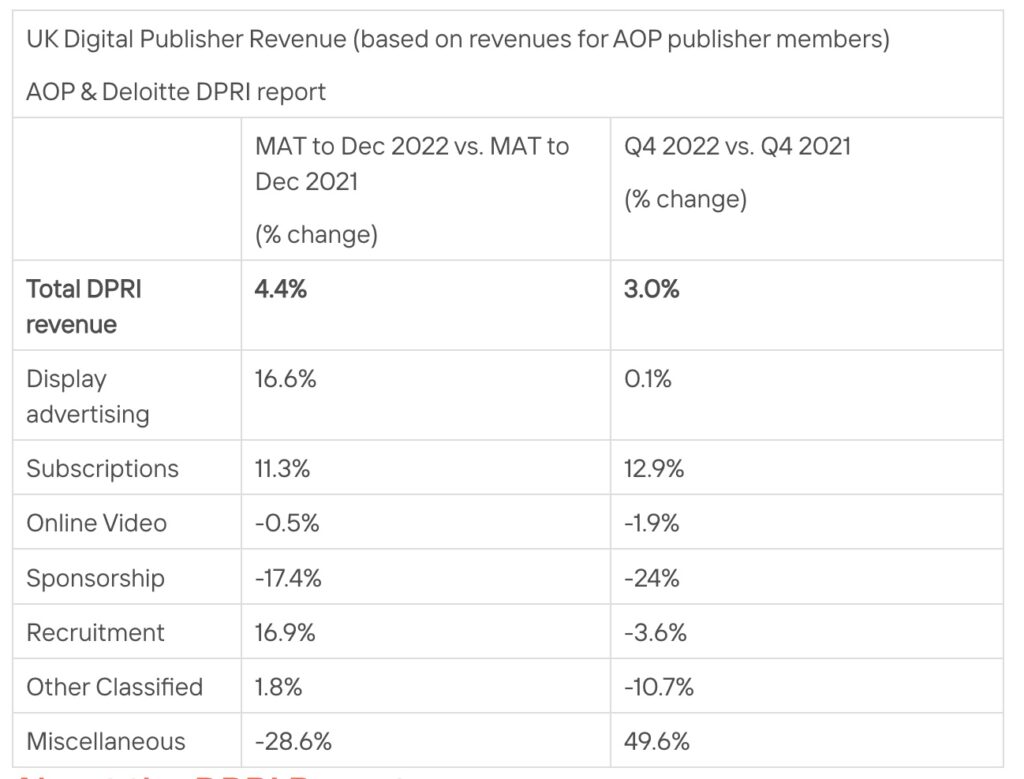

Despite the economic downturn, app and mobile publishers appear optimistic. Digital publishing revenues jumped 3% to £176.9 million in 2022 from the previous year, according to the latest data shared by the Association of Online Publishers (AOP) and Deloitte. So what’s driving growth?

Consumers are subscribers

Subscriptions saw the strongest growth among publishers in the final quarter of 2022, rising almost 13% year-on-year. It shows that audiences are still keen to consume premium content despite the cost-of-living crisis.

Display ad revenues stagnated at 0.1% while video revenues dropped slightly (-1.9%), according to the latest Digital Publishers’ Revenue Index (DPRI). Sponsorships dropped a whopping -24% in revenues.

Total digital revenues were up 4.4% to £637.7 million.

“It is reassuring to see that there is optimism amongst publishers, with 75% confident in the outlook for advertising revenues compared to just half at the same time last year,” said Dan Ison, lead partner for telecommunications, media and entertainment at Deloitte.

- Advertisement -The key to profitable app growth

Discover the secrets to driving sustainable app growth with our latest guide. Zero in on the crucial role of retargeting in mobile marketing to drive meaningful growth and user retention.

Download Now“Many consumers remain committed to their subscriptions, despite tighter budgets as a result of higher cost of living. It is evident that the appetite for exclusive content remains intact, making it even more important for digital publishers to continue to prioritise consistent, high quality outputs to maintain consumer interest and drive growth.”

UK digital publisher revenues rise 3% in 2022

Source: AOP

Multi-platform revenues see sharpest growth

The data reveals a clear shift from desktop to mobile devices with mobile rising almost 17% and desktop revenues falling 9.5%.

Multi-platform captures the largest share at £121.6 million (compared to £26.6 million for mobile alone), an increase of 3.7%.

The growth is due to video (33.3%), subscriptions (12.9%), and display advertising (8.1%).

However, better performance was skewed toward the biggest players with 43% of respondents reporting growth. A whopping 75% said they were prioritising cost reductions, up 50% from 2021. That said, 75% said they were optimistic about ad revenues going forward as inflationary pressures could hit a peak and balance out the share of growth.

Key takeaways

- Digital publishing revenues jumped 3% to £176.9 million in 2022

- Subscriptions saw the strongest growth at 13% year-on-year

- Display ad revenues stagnated at 0.1% while video revenues dropped slightly (-1.9%)