Mobile gaming is growing worldwide at a tremendous pace and there has never been a better time for game publishers to expand their businesses to new markets and new users. With a 7% average annual increase in active players worldwide since 2017, there are now 1.4 billion mobile gamers and this is forecasted to grow to 2.5 billion by 2025.[i]

Less mature mobile gaming markets are seeing a surge in the number of active players. This is a result of the continuous development of mobile devices and faster internet becoming more accessible worldwide. In fact, a recent report by 2CV titled “Why The Ad-Supported Model of In-Game Advertising Is A Win-Win-Win” showed that around three quarters of people in Turkey, Vietnam, Brazil, Argentina, and Russia have played a mobile game in the last month.[ii] These figures are comparable to Western & Asian countries that have been traditionally deemed more technologically advanced.

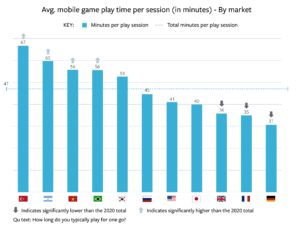

Beyond the rising number of mobile gamers, engagement amongst players has also gone up. The 2CV report notes that emerging markets such as Turkey, Argentina, Vietnam, and Brazil showed significant increase in average mobile game play time with markets like Turkey seeing an impressive 67 minutes of play time per session.[iii] Compare that with mature markets such as Japan, United Kingdom, and Germany which saw 40 minutes, 36 minutes, and 31 minutes respectively, emerging markets are going to be key growth markets for game publishers in the years ahead.[iv]

Growing Sustainably

As the mobile gaming industry thrives, new monetisation challenges arise for game publishers who wish to build a sustainable revenue model. To maximise the opportunities ahead, mobile game publishers would need to ensure that they have the right monetisation strategy in place. The de facto monetisation route for game publishers has been in-app purchases (IAP). In-app purchases have historically been the go-to choice for many publishers. However with only 3.8% of players making in-app purchases, the scalability of this strategy is limited and the returns expected to diminish as more and more games hit the market to compete for these paying players.[v]

Game publishers need to look beyond an IAP-only strategy to ensure that they maximising their monetisation opportunities from their player base. One viable monetisation method to incorporate is in-app advertising (IAA). With in-app advertising revenues predicted to grow to $35 billion by 2024 from $13.8 billion in 2019, its growth outpaces that of in-app purchase revenue growth and is a key revenue stream that should not be overlooked by publishers.[vi]

Publishers need to identify and implement the right monetisation mix and for many, this means adopting a hybrid monetisation model (IAP + IAA). This is inline with a survey carried out by Walnut Unlimited which showed that 69% of larger developers chose a hybrid model for monetisation.[vii] Though there may be a concern that in-app advertising cannibalises in-app purchase, the contrary is actually true with 86% of game publishers actually seeing in-app purchase levels unaffected or even climb when in-app advertising were implemented alongside.[viii]

Expanding Cross Border with an Ad-Supported Model

It has long been a misconception of game publishers that in-game advertising is not well perceived by players. However with an increasing number of publishers adopting ads and more research and testing being released to measure the impact of IAA, these myths are dispelled and players do indeed understand the need for ads as a fair value exchange for them to access the game for free.

The introduction of rewarded ads has further aided in cultivating this acceptance. Types of rewarded ads, like rewarded video, has changed the dynamics of the player-publisher exchange. What was once an exchange for access has become an exchange for in-game currency and cosmetics, providing the gamer with the unique ability to control the exchange.

The same 2CV report which was commissioned by Facebook Audience Network found that emerging markets in EMEA appear to be particularly receptive to rewarded video ads. 56% of Turkish gamers and 55% of Russian games surveyed said they played games longer due to seeing rewarded video ads which was noticeably higher than that of more mature markets such as UK with only 44% repeating the sentiment.[ix] The report also showed that rewarded video ads were able to increase session frequency with 55% of Turkish players and 45% of Russian players saying that they played more because of ads.

A quote from one of the Turkish respondents,

“If you watch a 30 second video and get an extra life or some currency for the game, it gives me an extra boost to keep playing, especially if I was low on lives in the first place!.”

In fact Antonio Margaritelli, associate director at 2CV, said in a recent webinar titled “Expanding your game Cross-Borders”,

“There’s little evidence that in-game ads lead to a high level of churn. Nine in ten players state ads have not impacted their desire to keep playing mobile games on more than one occasion”

With longer and more frequent sessions, players would have more opportunity to engage with ads giving advertisers more chance to interact with these players and ultimately leading to increased in-app advertising revenue for game publishers – truly a win-win-win scenario for all parties. With its rising acceptance amongst players, especially in emerging markets, and its potential to drive revenue growth, the adoption of IAA into the monetisation mix is a strategy that game publishers cannot afford to overlook. When expanding into new markets, game publishers should consider their game type, genre, and user profile as they work towards finding the right balance between IAA and IAP.

To learn more on how a hybrid monetization strategy can aid in game growth, check out the Expanding your game Cross-Borders webinar

References:

[i] Mobile Marketer– Mobile games sparked 60% of 2019 global games revenue. Published Jan 2020

[ii] 2CV Report

[iii] 2CV Report

[iv] 2CV Report

[v] Lifetime Value: The Cornerstone of App Marketing by Apps Flyer

[vi] IDC – Worldwide Mobile and Handheld Gaming Forecast, 2020-2024

[vii] Walnut Unlimited Report

[viii] Walnut Unlimited Report

[ix] 2CV Report

[x] 2CV Report