Our company has been collecting insights and relevant statistics in fintech and banking for many years. Understanding the industry is a must for narrowly specialized software development. Recently we’ve got interested in digital financial services ecosystems.

The purpose of this article is to reveal how technologies can help banks outreach to SME customers and why the implementation of e-invoicing is one of the most strategically sound ways to start a financial services ecosystem. Or at least to keep the bank’s market rank.

We are sure that the Open API trend is not even a trend anymore: it is an important investment sphere if the banks are aiming at digital expansion. Open API implies that more partnership options become available for banks.

Trend: Ecosystem

Opening up for fintechs and non-financial services requires a good strategy and preparation. At the same time, if you ignore partnership opportunities, you ignore a new market niche with immense ability to grow.

Partnerships and Collaborations are the New M&A

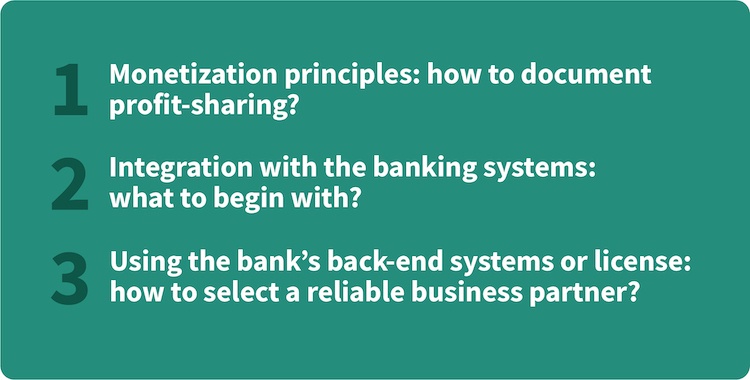

A decision to launch a new digital banking ecosystem may sound ambitious. In most cases, you need to involve third-party services provided mostly by fintechs. Looking for business partners, it is important to use mid-term strategic thinking: not all fintechs are equally good. To manage your expectations and realize priorities, banks need to consider the following aspects:

There is one more aspect to keep in mind: despite digital financial services ecosystems open lots of opportunities, banks find it difficult to add financial and non-financial services on their own. No wonder, as it requires extra resources. Besides, banks are just not structured for this, so partnerships can be a good way out.

Digital Financial Ecosystem + Open API

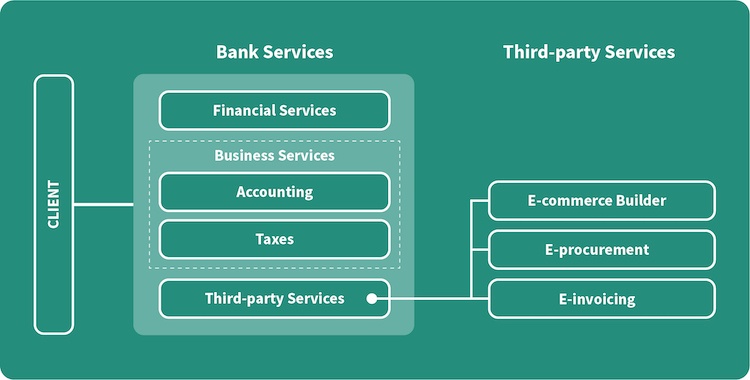

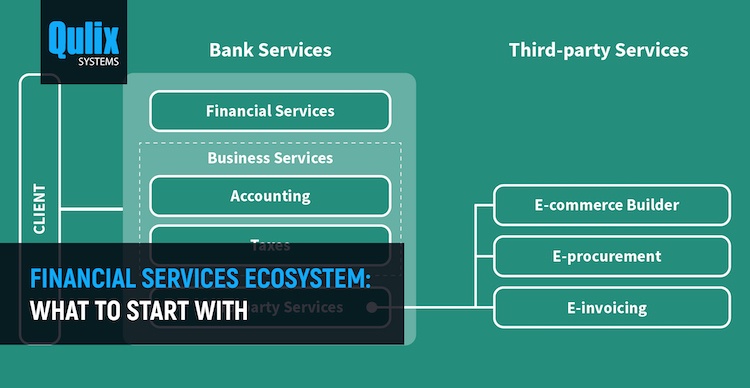

Banks develop a certain number of financial and business services for their customers. Third-party services integrated into the bank’s digital platform may include e-commerce builder, e-procurement, business finance management, factoring, e-invoicing and etc.

Let’s consider the example of e-invoicing to see how third-party financial services can facilitate the work of SMEs and build their loyalty to your bank.

E-invoicing makes B2B payments trouble-free

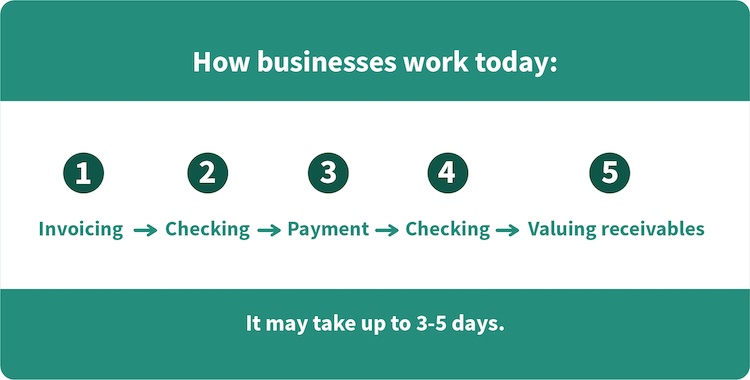

Dealing with payments is a tedious task for small and medium-sized enterprises. Surely, it depends on the country legislation, let’s see how it works in Eastern Europe, for example:

- Invoicing: businesses need to request the payment details and input them in documents.

- The payment details are received by the business partner. They are entered in the documents one more time.

- To value receivables, it is necessary to verify if the payment was processed successfully.

We know that in many countries the process is similar. It takes too much effort in the times of digital banking transformation, isn’t it? Businesses need a clear and simple payment process and automated control of transactions. It helps to verify payments in real-time and avoid debts.

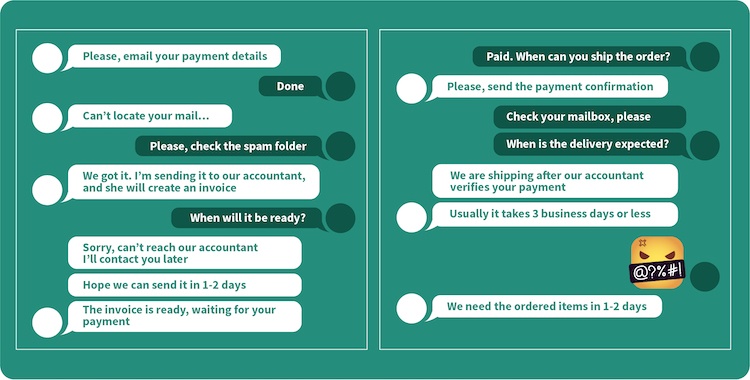

Instead of this, B2B payments are followed up by miles of messaging history:

🔍 Master Onboarding with JTBD & MaxDiff

Discover how to optimize your app’s onboarding process using the Jobs-to-be-Done framework and MaxDiff analysis.

Download nowIt’s not a big issue if the business has two or three transactions a month. But what about businesses, which process hundreds or thousands of payments monthly?

Electronic invoicing: outline

- Ready e-invoices are sent to business customers in a few clicks

- Manual or automatic performance

- Complete support of subscription payments and repeated purchases

- Payment status control

- Notifications for debtors

Benefits of e-invoicing

E-invoicing is able to revolutionize B2B payments – if banks are ready to implement a third-party service like this or are able to develop it with the help of software vendors.

E-invoicing software is a digital assistant dealing with payments and tracking them within minutes. Businesses (and their banks) interact seamlessly via the cloud service. We believe that Independent multi-bank e-invoicing services offered on the revenue-share model have a greater potential than separate bank’s platforms. They can engage more users and provide benefits to all parties involved.

Is it a win-win situation?

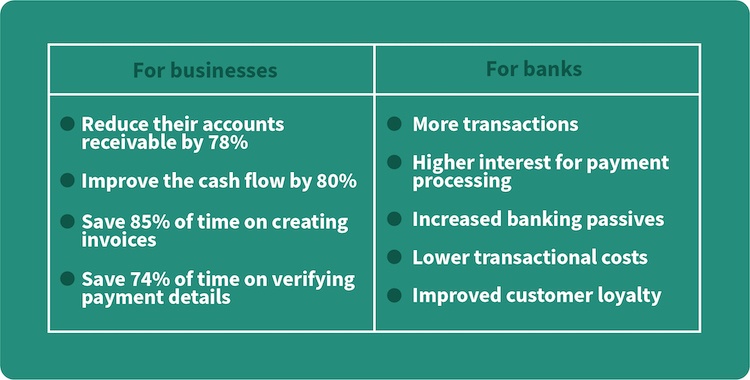

E-invoicing has advantages for both businesses and for banks:

It’s a great option to start with third-party digital services and to win SMEs by making B2B transactions faster and easier.

To implement the prototype service, banks should be ready to provide open API related to:

- Authorization

- Accounts and transactions data

- Payment data

In this case, SME customers will be able to make use of flexible workflow with payments, partial payments, and payment plans. E-invoicing services help to verify first-time contractors using third-party databases. It is carried out with the help of the digital signature. Another feature that businesses appreciate the access to the transaction history with filters.

For example, if it is a multi-banking service, customers can use in using their mobile banking app (integrated with e-invoicing), upload their digital signature, and enter the beneficiary account. The system will generate the payment order right away, sign it with the digital signature and securely sends it to the contractor using the bank’s API.

Final Takeaways

The implementation of such projects requires a careful analysis of the country’s law system, internal digital systems in banks and market demands. Also, it requires the assistance of experienced software vendors, especially when there is no in-house development team in the bank.

At the same time, e-invoicing is an opportunity to outperform your competitors by providing a comprehensive B2B payment service, which addresses the pain points of SME customers.

If you are searching for a software development vendor to implement a project in digital banking and finance contact Qulix Systems for a quote.