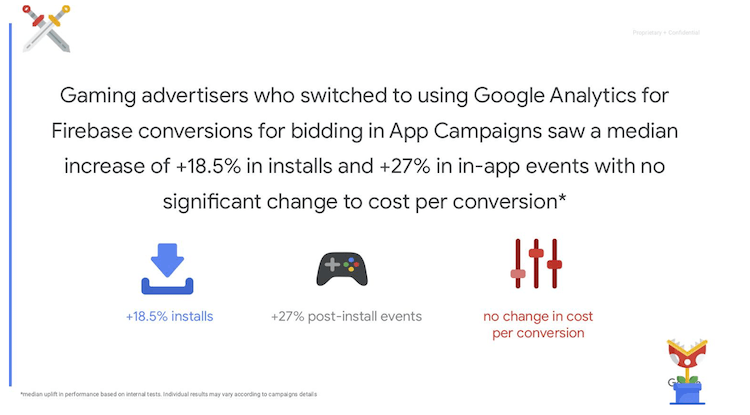

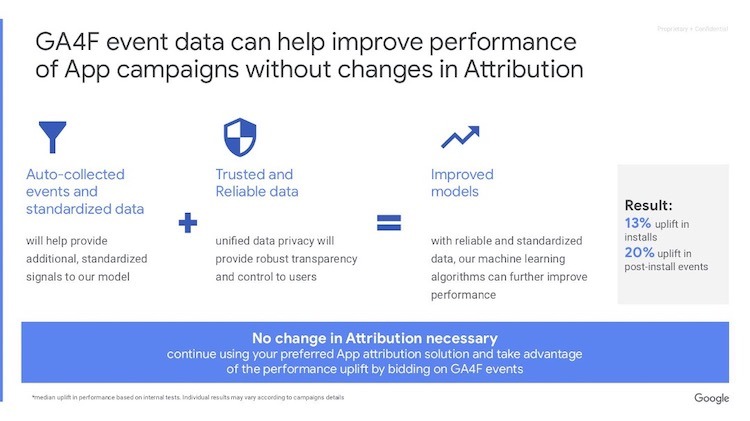

- Bidding on Firebase (FiB events) resulted in a median +13% increase in installs and a +20% increase in in-app events with no significant change to cost per conversion.

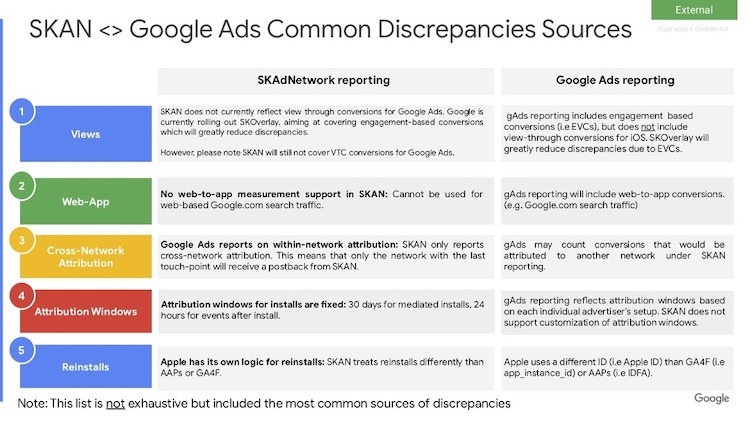

- Advertisers must understand sources of discrepancies between SKAN data and Google Ads reporting, which may include views, web-to-app, cross-network attribution, attribution windows, and reinstalls.

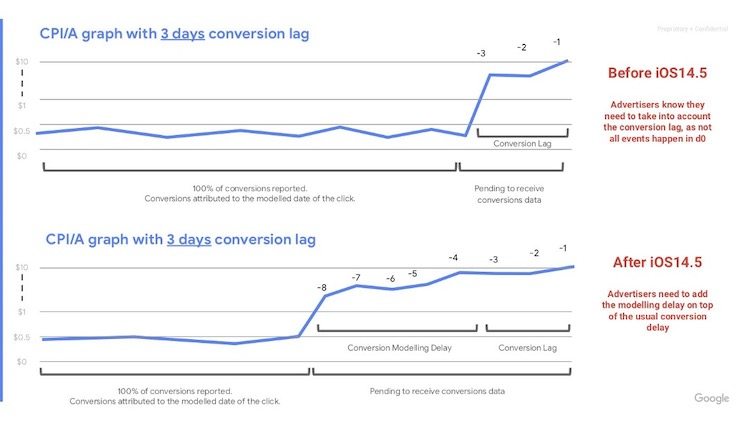

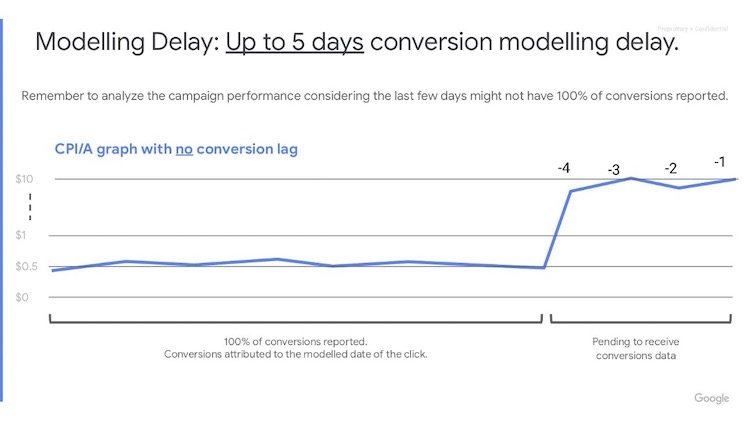

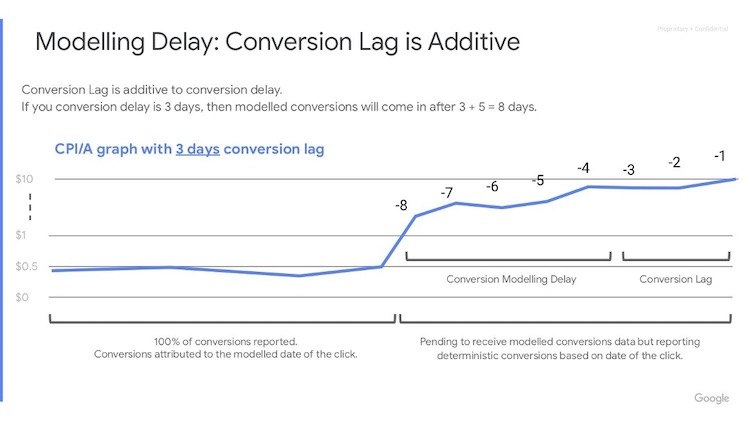

- For iOS campaigns, advertisers should expect at least a 5-day lag in app campaign modeled conversions and should avoid assessing performance in the first two weeks or before the campaign has generated at least 100 conversions

- All the best practices for optimizing Google App Advertising, based on what’s working now for our clients

As mobile app advertisers adjust to an evolving ad ecosystem with the loss of IDFA and increasingly automated media buying across networks, Consumer Acquisition brings you the most up-to-date recommendations for Google App UA Campaigns. As a Google App Preferred Creative Partner Agency, we have market insights and creative expertise from managing over $3 billion in creative and social ad spend for the world’s largest mobile apps and web-based performance advertisers.

Here’s how to better understand, measure, and optimize your Google App UA campaigns right now.

Bidding on Firebase (FiB) events increases performance

App campaigns bidding on FiB events performed better than app campaigns bidding on non-FiB events. Google reports that the median campaign that switched to using Google Analytics for Firebase conversions for bidding saw a +13% increase in installs and a +20% increase in in-app events with no significant change to cost per conversion.

|

|

Understanding Google Ads reporting vs. SKAN

Adjust and Appsflyer dashboards now show Google SKAN data. Below are the sources for common discrepancies between SKAN data and Google Ads reporting, including views, web-to-app, cross-network attribution, attribution windows, and reinstalls.

Understanding the iOS conversion lag

For iOS campaigns, advertisers should expect up to five days for modeled conversions to appear; SKAN conversions may take longer due to its 24-hour timer resetting every time a conversion is tracked, up to 64 times. Conversion lag is in addition to typical conversion delay.

|

|

- Campaigns targeting deeper funnel events must account for conversion lag before assessing performance; if conversions happen more than a week after an ad is served, performance data must reflect the longer window plus conversion delay, or attribution is lost.

- If viewing campaign performance daily, be sure to view conversion data in a lookback window that includes the lag and delay.

- Performance fluctuation should be expected due to initial learning and subsequent optimization

- Avoid assessing campaign performance in the first one to two weeks and before the campaign has generated at least 100 conversions

- Assess performance based on if the campaign is meeting its set tCPI/tCPA and daily budget on a monthly average basis

What’s working for us right now

Along with the recommendations directly from Google, our UA experts are seeing:

- Strongest performance from English language targeting Germany, UK, France, Canada & Netherlands

- French and German language campaigns targeting tier 1 countries in Europe show promise

- Key performance lever is the bid, adjusted periodically based on 7D ROAS

- Targeting only Android devices; iOS campaigns when tested in Q1 had low yields

For timely tips and trends, head over to September’s Hot Tips article to see what’s working on Facebook, TikTok and Snap right now.

The basics of optimizing Google App Advertising campaigns

Here’s a punch list of best practices for optimizing Google App Advertising, based on what’s working now for our clients.

- Use a target CPA (tCPA). If you haven’t tested this bidding strategy yet, start now. We’ve found it to be a very efficient use of ad budget.

- Use a target return on ad spend (tROAS). This feature isn’t out just yet, but it will be available in June for App Campaigns on iOS and Android. Once it’s live, you’ll be able to, say, specify that you want Google to find users who will spend three times what it cost you to acquire them. What advertiser wouldn’t want to do that?

- Set your daily budget caps at least 50X target of CPI or 10X of target CPA.

- Don’t change target CPI/CPA bids more than 20% in 24 hours until your campaign is generating 20-30 targeted in-app events per day.

- Target CPI campaigns’ bid should start at least $4-5, even if your CPI goal is lower.

- Target CPA campaigns’ bid should start at least 20-30% higher than the goal.

- Don’t wait until your app has launched to start building your user base: Pre-launch campaigns are available, and they work.

- Be generous with creative assets. Google App Campaigns work best with a variety of creative – both creative formats and messaging approaches. The algorithm will figure out how to mix and match your images, text, and videos… but you’ve got to give it enough assets to find the ideal combination.

- Always include video creative. We’ve found that if a campaign hasn’t been using videos, adding just two videos to their creative asset mix can increase the campaign’s conversions by 25%. So yes, maybe videos are a bit more expensive. Maybe they do take a bit longer to create. But they punch above their weight when it comes to ROAS. And besides – if you don’t want to make videos, we can do it for you.

- When you get your videos made, make sure they can “flex,” as in that they can appear in different views and devices, and still look good.

- Think beyond user acquisition. We’re seeing some really nice returns with retention campaigns. If you do it right, it absolutely pays to advertise to all those people who downloaded your app but then either didn’t use it or never bought from it. They’ve already done the hard part of installing the app – often they just need a little nudge to activate or to make their first purchase.

Why trust our UA tips?

- Founded in 2013, we are a technology-enabled marketing services company and creative studio that has managed over $3 billion in creative and social ad spend for the world’s largest mobile apps and performance advertisers.

- We provide end-to-end creative and user acquisition services for mobile app marketers via performance-oriented creative storytelling, integrated UA, and creative optimization.

- We provide game-changing results driven by quantitative optimization and a relentless focus on increasing your net profit driven by client-specific, creative learning agendas.

- Clients we’ve helped grow: Roblox, Glu Mobile, Disney, SuperHuman, Rovio, Jam City, Wooga, NBA, MLB, Ford, Sun Basket, Lion Studios, MobilityWare, and many others.