While there are lots of ways to listen to customers, mobile surveys are among the most effective. And right now, as consumers engage with brands primarily from home while the world grapples with the macroeconomic impacts of COVID-19, mobile outreach is a critical channel for feedback, engagement, and revenue.

Mobile surveys help brands access large volumes of consumer feedback in real time—but only if they’re used correctly. In our recently-published 2020 Mobile App Engagement Benchmark Report, we looked at the number of surveys apps across categories sent over the last four years, and compared findings to how response rates have changed.

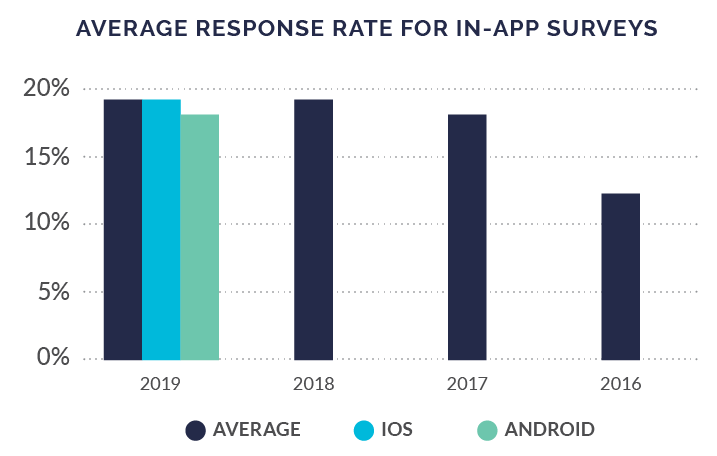

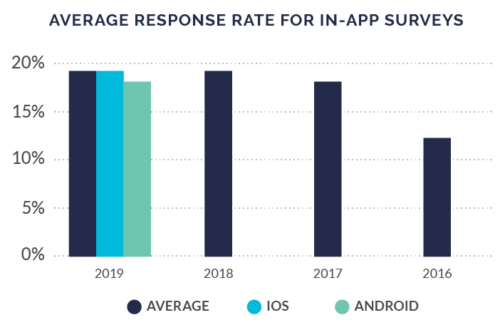

In 2019, apps sent 44,849,700 consumer surveys, which is a 29% increase from 2018. The most surprising (and satisfying) finding is that even with the year-over-year increase in the number of surveys sent, the survey response rate held steady at 18% compared to 2018’s 19%.

Another important distinction is that, on average across industries, brands only hear from ~1% of their customers surveyed. With 1% as the baseline, an 18% response rate is off the charts. The large increase in surveys with a steady response rate is due to sending in-app surveys at the right mobile moment, coupled with intelligent survey questions.

Luckily, creating well-received mobile surveys that encourage a major increase in response rate is easier than it may seem. Let’s move onto steps to get you started.

3 steps to better mobile surveys

Mobile surveys are powerful in understanding customer sentiment, but only if they’re used correctly. Here are three actions you can take immediately to improve your survey response rates and gather better, deeper customer feedback.

Keep your surveys short and specific

When it comes to mobile, short surveys with specific asks (like feedback on a new feature) are effective and efficient. You’re probably all familiar with the 30-question surveys that pop up as soon as you open an app or website. How many times have you actually completed a survey that long on your smartphone? Probably never. To encourage more people to complete your survey, limit the amount of questions you ask. Try to keep it between four to six questions to increase your chances of receiving more fully completed surveys.

To determine whether or not a question is needed, ask yourself, “Is this question absolutely necessary?” and, “Is this the only way to capture this information?” If the answer is no to either, the question won’t add value and shouldn’t be included. Also, gather as much information as you can via metadata and analytics to minimize the need for questions that can be answered through those channels.

Find the right “mobile moment”

In addition to content, timing of surveys is critical. A survey that interrupts a customer’s in-app experience will rarely be well-received. If you have the right audience, but you ask them at the wrong time, your survey won’t yield valuable results.

Be respectful of the customer’s mobile experience, and ensure that your request for feedback doesn’t interrupt them and is contextual. For instance, if your goal is to understand how customers feel about a new feature, the right time to survey them about it is immediately after they’ve used the feature. You’ve given them time to use the feature and establish feelings about it. By asking immediately (or soon) after they’ve finished using the feature, the experience is still fresh in their mind and you’ll receive honest survey results.

Refrain from displaying surveys when customers have started an action, such as the checkout process, or when the customer first launches the app and instead opt to show a survey at close, completed, or back buttons.

Maximize App Growth with #1 App Store Optimization Company

Expand app store reach, increase downloads, boost engagement, lower acquisition costs & achieve higher user LTV with our leading ASO services & technology

Contact Us TodayGo beyond Net Promoter Score (NPS)

NPS is still an important political number, but it’s a method of measuring customer sentiment that falls on a flat scale. Over 150 S&P companies cited NPS in 2018 earnings calls. Bonuses are based on it. Millions of dollars are spent managing it. Every industry captures it. But we see NPS alone as a vanity metric that does not give you the “why” behind customer emotion—the thing you must act on in order to affect change.

Another common mistake with NPS is that it is not prompted in a timely manner. For example, many brands prompt NPS long after an experience has concluded, via email, SMS text, or web survey rather than in their app. This lag does not provide a cohesive in-app experience, and does not allow brands to close the loop with detractors with a note or conversation to understand the emotion behind their sentiment.

It’s better to look at customer emotion holistically than in a vacuum, even if it produces a lower NPS. Rather than gaming the system and inflating your NPS by targeting fans over risks, it’s better to target the whole and learn from feedback—which is also what makes NPS a vanity metric. You cannot act on emotion you haven’t collected, and NPS doesn’t tell us a thing about the “why” behind customer emotion.

Wrapping up

Mobile surveys are one of the fastest ways to gather feedback from thousands of your customers quickly. But if your survey is full of poorly written questions that discourage customer participation, the benefits aren’t as profound.

If you’re interested in learning more about mobile surveys, check out the Apptentive approach. We’d love to help!