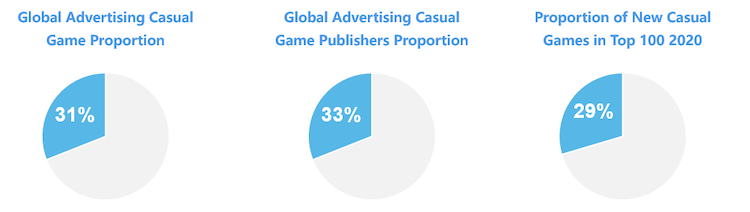

Overview of Casual games advertising in 2020

The competition for casual mobile games was fierce. Casual games accounted for 31% of the total mobile game’s ads, and casual game publishers accounted for 33%.

Source: App Growing Global

Top casual mobile games have a long lifecycle. In the Top 100, the number of new casual games in 2020 accounted for only 29%. Old mobile games accounted for 71%, proving that the lifecycle of top Casual mobile games is relatively long and favors long-term advertising campaigns.

Source: App Growing Global

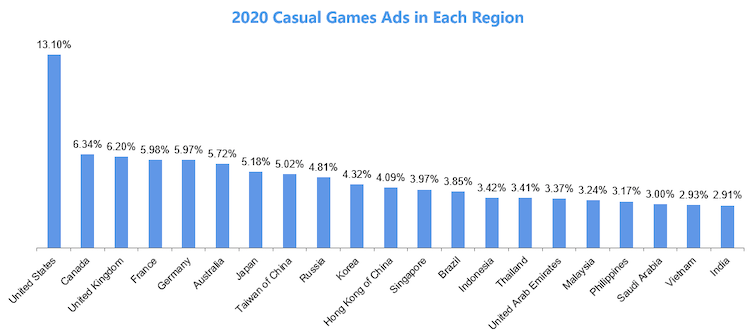

Putting together the number of ads for Casual mobile games in various regions, the United States accounted for 13% of the ads, the largest Casual mobile game market, followed by Canada and Europe.

Source: App Growing Global

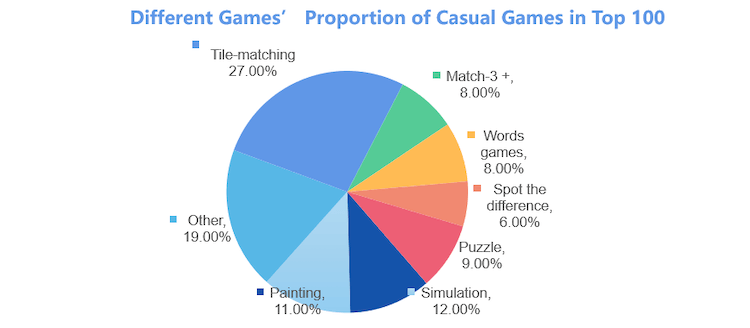

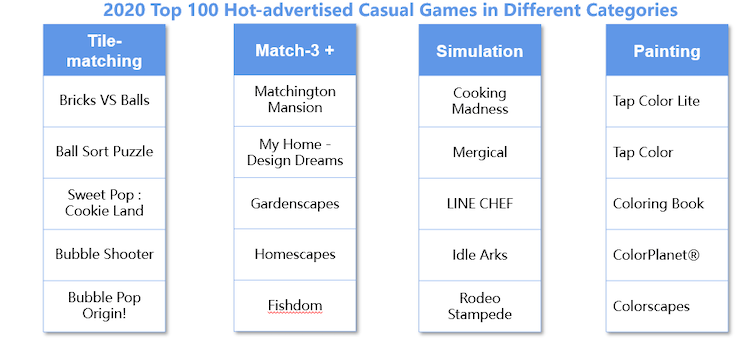

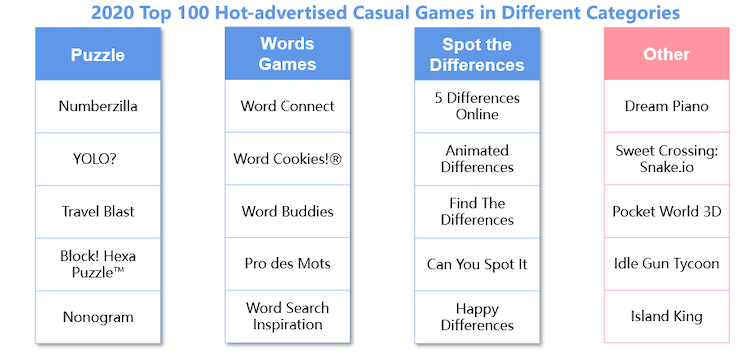

Top 100 casual games are further subdivided, and match-3 Casual games dominated, accounted for 27%. Other popular sub-categories in 2020 included Painting, Simulation, Puzzle, Match-3+, Words, and Spot the Difference.

Source: App Growing Global

Review of top Casual games of 2020

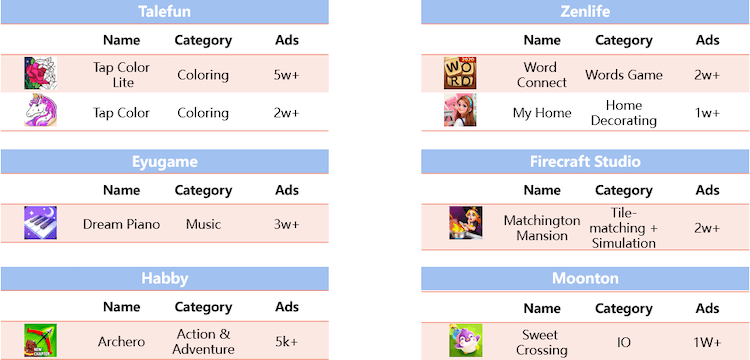

Among the top Chinese mobile games for the global market, casual games’ advertising is outstanding.

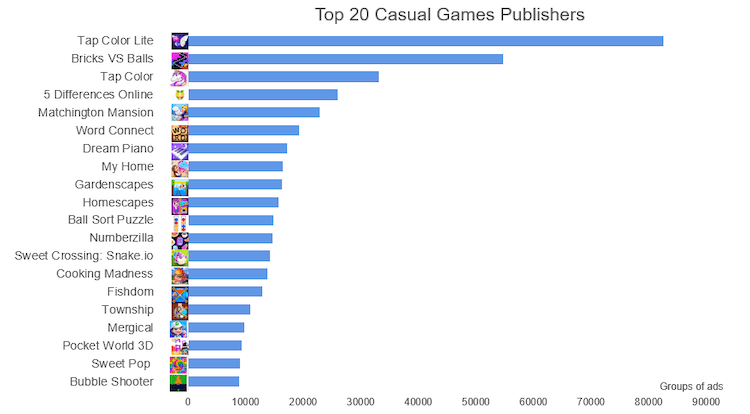

There are 8 games from Chinese publishers in the Top 20, namely Talefun’s “TAP COLOR” and “TAP COLOR LITE”, Acoin Games’ “BRICKS VS BALLS”, Magic Tavern’s” MATCHINGTONG MANSION”, Zenjoy’s “MY HOME” and “COOKING MADNESS”, Eyugame’s “DREAM PIANO”, Moonton’s “SWEET CROSSING”.

Source: App Growing Global

Playrix’s “GARDENSCAPES”, “TOWNSHIP”, “FISHDOM”, “HOMESCAPES” kept pushing their advertising campaign strongly and made it to the Top 20.

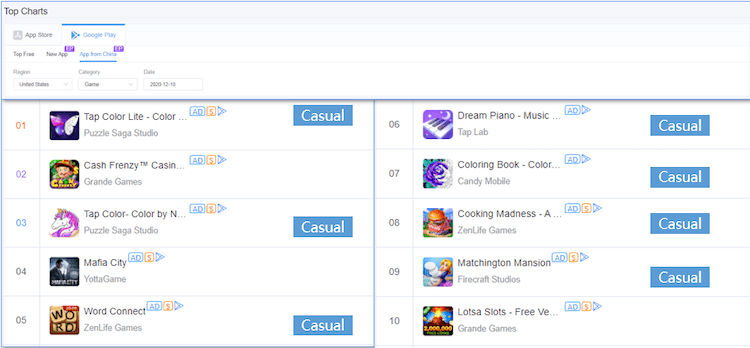

Take App Growing Global’s Google Play App from China list on 12th of October as an example. Seven of the top 10 games are casual games, and there was a fierce competition in top casual games advertising.

Source: App Growing Global

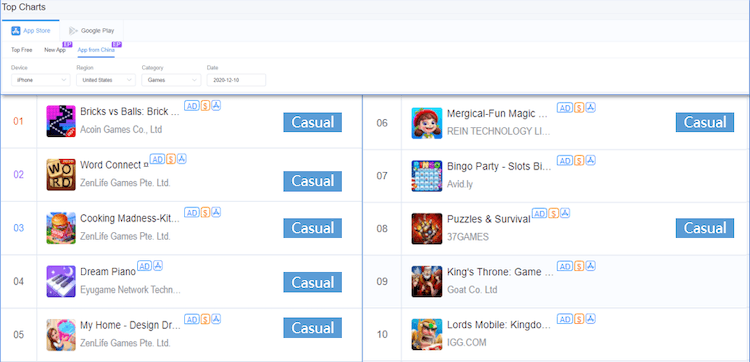

Next up is the 12th of October Chinese App Growing Global iOS App list, top games also competed fiercely, but there are more categories, including Simulated operation, Music, Match-3 + SLG, etc.

Source: App Growing Global

Bubble shooting games represented Tile-matching games; Match-3 + games are mainly combined with Simulation; Cooking Simulation games are the most popular simulation games; painting games are mainly Coloring games.

🔍 Master Onboarding with JTBD & MaxDiff

Discover how to optimize your app’s onboarding process using the Jobs-to-be-Done framework and MaxDiff analysis.

Download nowSource: App Growing Global

Puzzle games were mainly about math and plot; other popular Casual games included the Music game “DREAM PIANO”, the IO game “SWEET CROSSING”, etc.

Source: App Growing Global

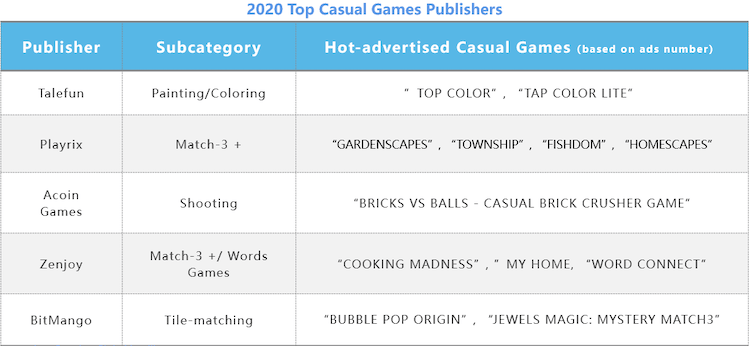

Talefun, Playrix, Acoin Games, Zenjoy, Bitmago all pushed strong advertising campaign this year, but all have their own fields of expertise.

Source: App Growing Global

Main Advertised Casual Games by Chinese Publishers

Source: App Growing Global

Advertising Creatives for Different Types of Casual Games

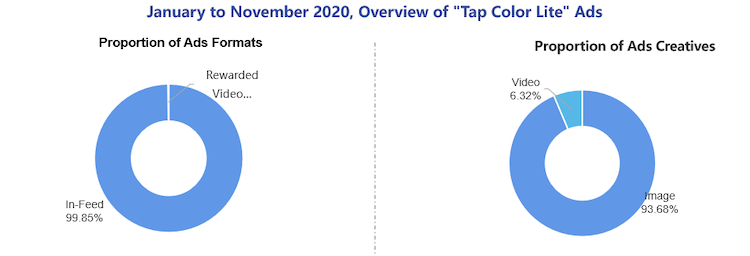

Case Analysis 1: Talefun’s coloring game “Tap Color Lite”

Ads are mainly an in-feed image.

Talefun’s coloring game “Tap Color Lite” Attract players to try by showing the gameplay and result quickly.

Ad creatives are mainly situational short videos, the protagonist tried to get rid of all kinds of an embarrassing situation but failed.

Above ad creatives designed by App Growing Global.

Super popular music rhythm tapping video, PK between players is thrilling.

Above ad creatives designed by App Growing Global.

Casual Games Ad Creatives Summary

(1) The most important thing is to let the players get the core gameplay immediately.

The biggest attraction of casual games to users is that the gameplay is easy, and it can bring out the fun of the game. Bright style is usually more eye-catching.

Above ad creatives designed by App Growing Global.

(2) Make the player competitive.

In terms of displaying plot settings for luring people to try, it usually is “failed-correct-pass” and “continuous failure”.

Above ad creatives designed by App Growing Global.

(3) Arouse players’ curiosity and use conformity psychology.

Usually, real/offline familiar game scenes are used, or the material is integrated into real-life scenes with social elements. As shown in Image 2 on the right.

The above report is based on global app (non-gaming) advertising strategies tracked from January to August 2020, and all data sourced from App Growing Global Intelligence. It covers 20 countries/regions such as Europe & America, Southeast Asia, Taiwan of China, Hong Kong of China, Middle East, Brazil, etc., and 17 global mobile advertising platforms including Facebook, Admob, Unity, Line Japan, Twitter, etc.Please log in App Growing Global to get more information.