The emergence of utility apps has brought significant changes to how people optimize their devices and accomplish practical tasks, offering enhanced convenience and efficiency. This article delves into a comprehensive analysis of the top 10 utility apps available in Japan’s App Store and Play Store, uncovering valuable insights by examining metadata keywords, design patterns, features, and user reviews. This research provides a glimpse into the prevailing trends and user preferences within the Japanese utility app market.

To conduct this analysis, a meticulous evaluation was undertaken to identify the leading 10 apps within the Utility category of Japan’s App Store and Play Store as of June 2023. It’s important to note that the rankings and overall popularity of these utility apps may vary over time.

These apps were selected based on their popularity, ratings, and relevance.

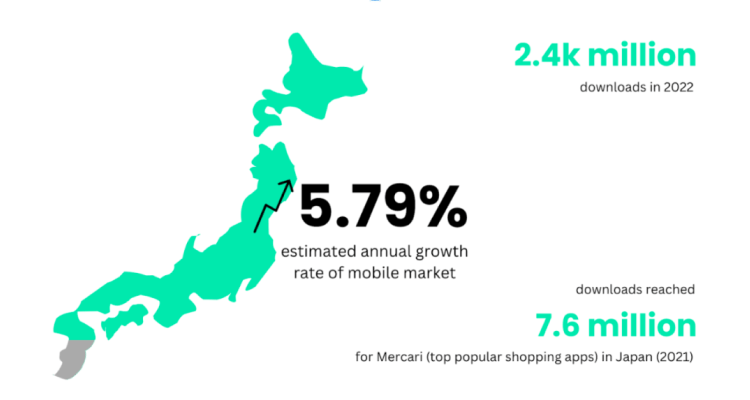

Japanese mobile app market

Source: Statista

According to Statista, the estimated annual growth rate of the mobile market in Japan is 5.79%. With the number of total downloads in 2022 reaching 2358 million, 9.22% of the total app share in the App Store is categorized as utility apps.

The utility category serves as a versatile option for developers to list apps that do not fall under other specific categories in the App Store and Google Play Store. Consequently, this category encompasses a diverse range of app functionalities, offering users a wide variety of options and features.

Top 10 utility apps

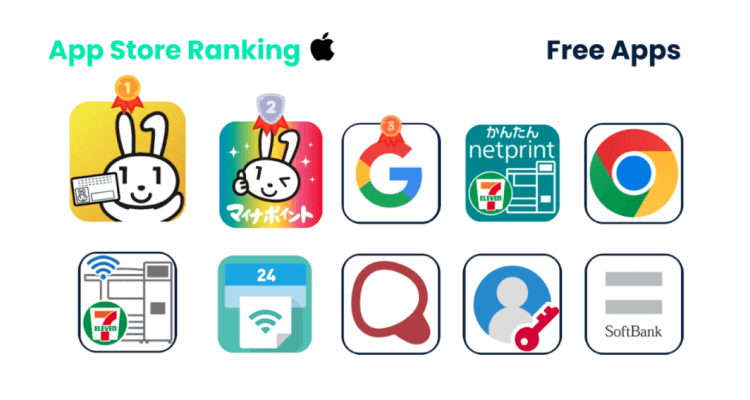

App Store

In the utility category of the App Store, the top positions are currently occupied by Myna and Myna Point. Myna is a Japanese personal number card-linked app that offers convenient access and management of personal identification and government-related services, while Myna Point provides additional features for earning and utilizing rewards linked to the personal number card.

Additionally, the presence of Google and Chrome apps in the utility section demonstrates how developers can enhance their app’s visibility by utilizing appropriate category and sub-category classifications.

App Store ranking for free apps

Source: aix

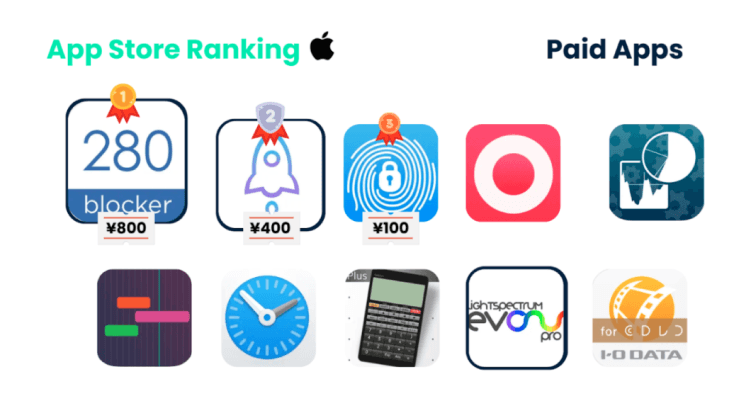

In the paid section of the utility category, the top-ranking app is 280 Adblocker, which effectively blocks ads and enhances the browsing experience. Priced at ¥800, it offers users an ad-free environment and additional features.

Other highly-ranked paid apps within this category provide a diverse range of services, including digital support and productivity management tools, catering to different user needs.

Fire Up Your Growth!

Moburst propelled leading brands like Google, Reddit, and Uber to the next level. Let’s ignite your Success journey today!

Claim Your FREE Growth Fuel!App Store ranking for paid apps

Source: aix

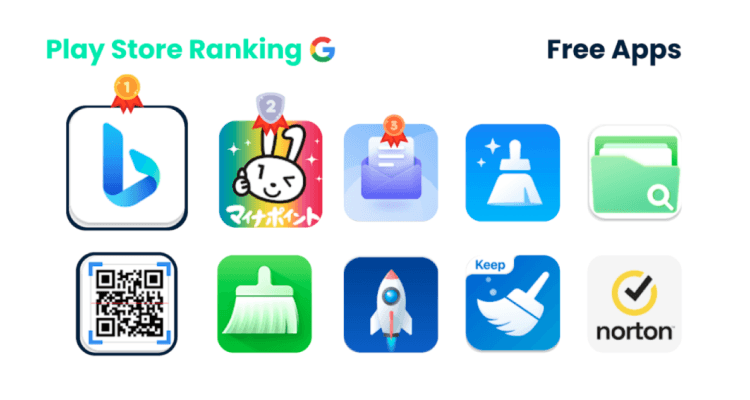

Play Store

In the Play Store’s free app ranking, Myna continues to maintain its popularity, alongside Bing AI Chat, a newly-emerged app that offers intelligent chatbot capabilities.

The remaining apps in the top 10 predominantly consist of system optimization and security solution apps, catering to users’ needs for optimizing device performance and enhancing digital security.

Play Store ranking for free apps

Source: aix

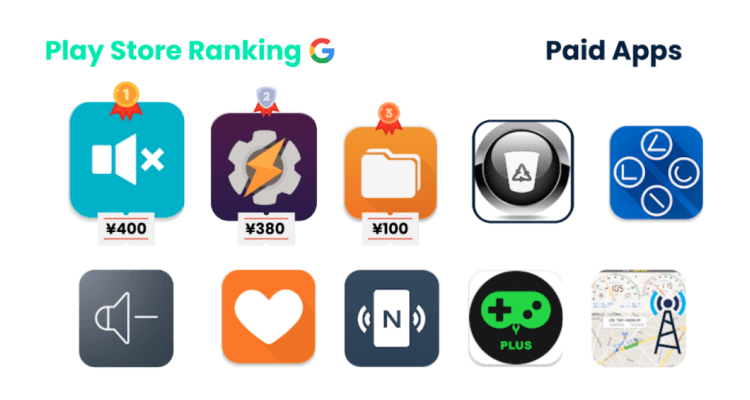

In the paid-app rank, Mute My Camera takes the lead at ¥400. This app is highly popular due to its automatic sound-on camera features, which are particularly relevant in Japan where unauthorized photography is prohibited.

The subsequent positions in the ranking are occupied by other phone optimization and customization apps, with prices ranging from hundreds to thousands of yen.

Play Store ranking for paid apps

Source: aix

Sub-categories and functions

As the Utility category offers flexibility and lacks specific restrictions, developers have the freedom to place a wide range of apps in this category. This allows for greater diversity and availability of utility-focused apps for users. Developers can leverage this opportunity to provide innovative solutions, address various user needs, and explore different functionalities within the utility space.

- File management: Helping users manage and organize files, documents, and folders on their devices.

- System optimization: Optimizing device performance by cleaning cache, managing storage, boosting RAM, and improving battery life.

- Security and privacy: Protecting user privacy and enhancing device security through features like app lockers, password managers, VPNs, and antivirus solutions.

- Backup and restore: Enabling users to back up and restore data, including contacts, messages, media files, and app data.

- Battery management: Monitoring and optimizing battery usage, providing battery statistics, power-saving modes, and battery health diagnostics.

- Device control and customization: Offering control over device settings, customization options, and additional functionalities beyond default system features.

- Network tools: Assisting users in monitoring and troubleshooting network connections, including Wi-Fi networks and mobile data, with features like network speed tests and Wi-Fi signal analysis.

- Productivity tools: Providing productivity features such as note-taking, task management, calendars, calculators, and conversion utilities.

- Measurement and conversion: Offering tools for measurement units, currency conversion, time zones, and other types of conversions.

- Miscellaneous utilities: Including various specialized functionalities like remote control apps, device tracking, weather updates, digital wallets, and more.

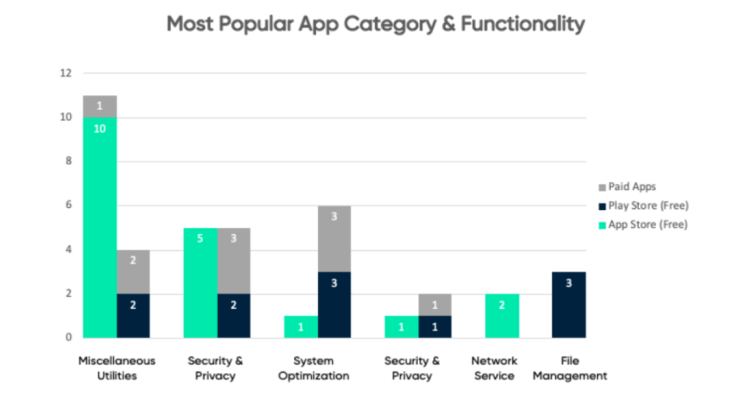

Among the above categories, some appear to be dominant among the top 10 Utility apps in both the App Store and Play Store:

Most popular app category and functionality

Source: aix

Metadata analysis

One essential factor in enhancing app visibility and discoverability is the strategic utilization of keywords in the app’s metadata. Based on our analysis, we have identified common keywords that frequently appear in the metadata of popular Japanese utility apps.

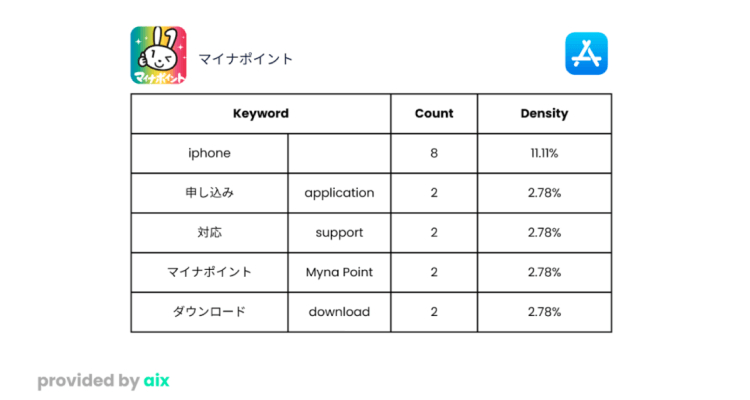

When focusing on utility apps, which constitute a significant portion of the rankings, we found certain crucial keywords within their descriptions. Taking the Myna Point app, a top-ranked Utility app on the App Store, into consideration, the following significant keywords were identified:

Myna Point keywords

Source: aix

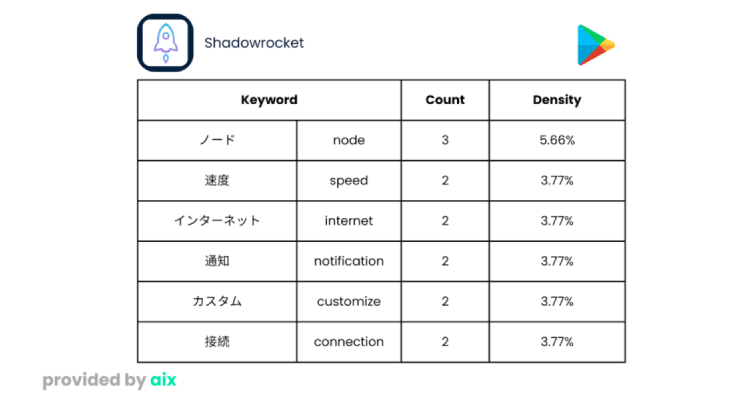

In the Network Services category, Shadowrocket, a ¥400 app that provides secure and optimized browsing capabilities, features the following keywords:

Shadowrocket keywords

Source: aix

With the above-mentioned examples, it can be seen that tailoring the meta keywords matters, with the significance of providing a clear, attractive description in the local language.

Design pattern analysis

Visual design plays a significant role in user experience. When it comes to designing utility apps in Japan, several popular design patterns reflect the essence of learning and appeal to users. These patterns include:

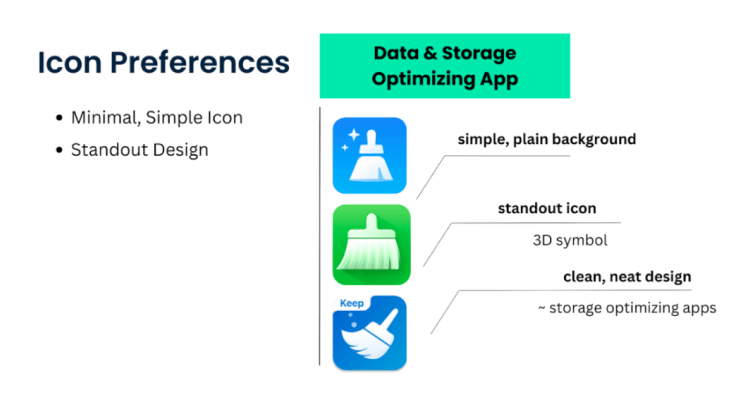

App icon

- Clarity and professionalism: A simple subject with a solid background is a popular design as it focuses on clarity and simplicity, making it easy for users to identify the app at a glance.

- Color psychology: Colors can evoke different emotions and perceptions. While security apps often set their presence with blue, which often stands for trust and stability, bright colors also make apps easy to identify.

Icon preferences

Source: aix

User reviews analysis

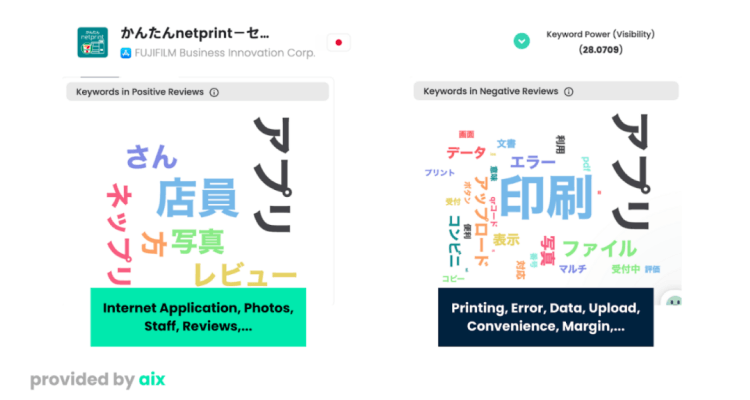

User reviews provide valuable insights into the app’s effectiveness and user satisfaction. Through the analysis of user reviews for the top utility apps, we identified common reactions, concerns, and suggestions expressed by users. Netprint by 7/11, one of the most popular Utility apps for the App Store, receives an overall rating of 2.94/5 with 1929 ratings. The significant keywords in user reviews are as below:

User review keywords

Source: aix

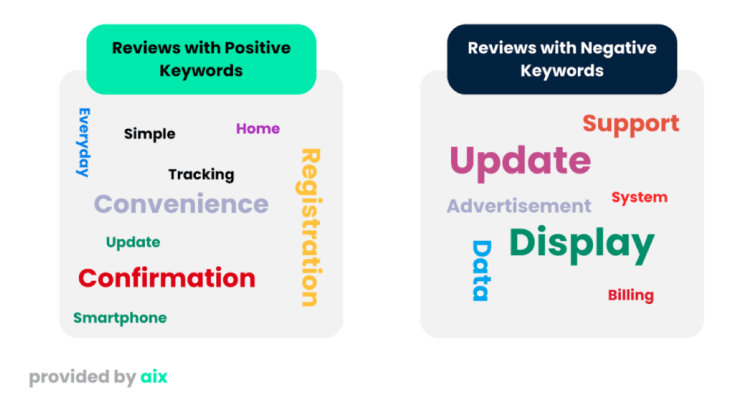

Other common keywords that can be found cross-app in the miscellaneous utility category include:

More keywords to consider

Source: aix

From the comprehensive analysis, app creators can regularly monitor and analyze user feedback to understand user satisfaction, identify areas for improvement, and address any concerns or suggestions raised by users.

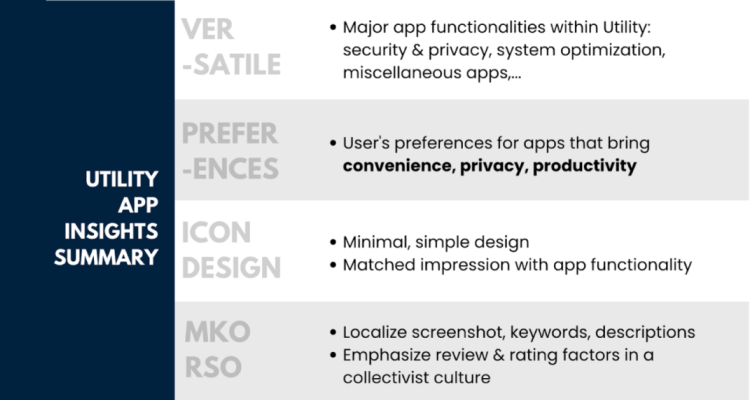

Insight summary

Based on the above elements, marketers can incorporate these below insights into app development and marketing strategies to better position the app to meet the needs and expectations of the Japanese audience.

- Aside from the dominant share of storage optimization and security apps, the utility app categories in Japan are still occupied by a significant number of miscellaneous apps, including point accumulation, service, and service-linked support apps. This highlights the Japanese consumers’ preference for convenience solutions and services.

- Japanese users prefer a simple, minimal icon and an information-fulfilled in-app visualization to provide them with enough essential information.

- Meta keywords should include keywords in your native language, English, kanji, katakana, and hiragana. The translation of these keywords should be done meticulously.

- As a collectivist culture, Japan values recommendations and reviews. Therefore, app creators should pay attention to review scores and adopt appropriate referral reward systems and positive word-of-mouth engagement.

Insight summary

Source: aix

Conclusion

As the demand for utility apps continues to rise, it is evident that they have become indispensable tools for privacy, productivity, and convenience in the digital age, aligning with the preferences of Japanese users. The comparative analysis of the top utility apps in Japan has yielded valuable insights into market trends and user preferences.

By examining keywords, design patterns, functions, and user feedback, app creators and developers can gain a deeper understanding of what resonates with Japanese users, allowing them to tailor their offerings accordingly. This knowledge empowers the development of more effective and user-centric utility apps that prioritize privacy, productivity, and convenience, ultimately enhancing the overall app experience for Japanese users across various age groups and backgrounds.

To stay informed about Japan’s mobile industry, make sure to read our insights at ASO index.