In the third quarter of 2023, the advertising industry experienced a significant surge in growth and creativity compared to the previous year. SocialPeta published a report delving into the diverse dimensions of the Indian mobile game market.

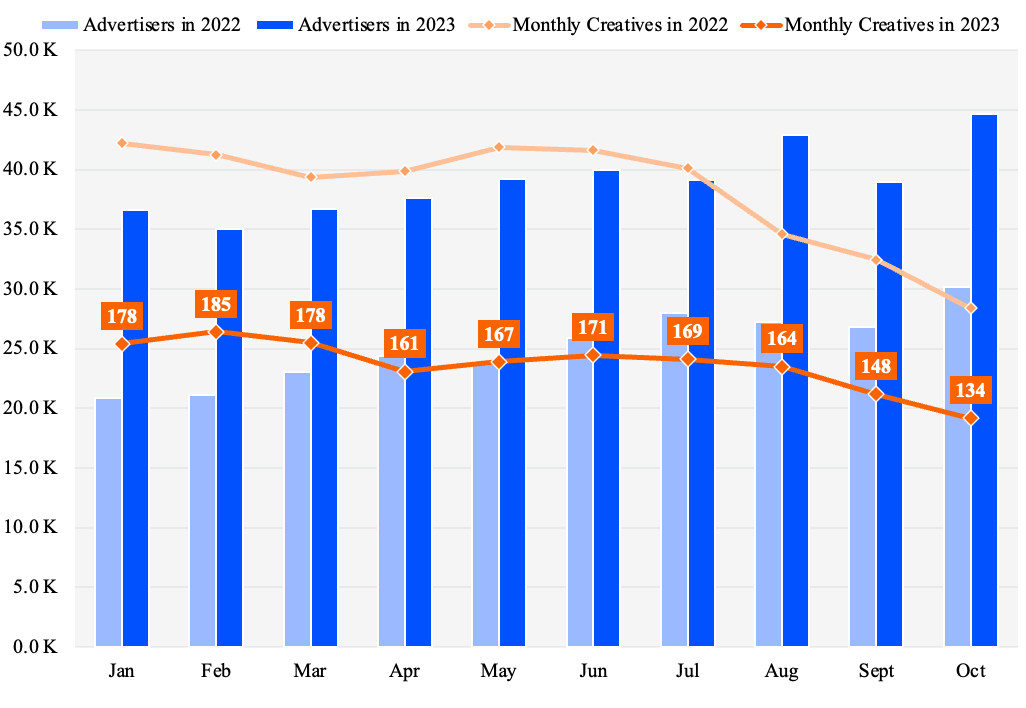

Q3 2023 saw a 2-year peak in advertiser growth and a surge in new creative releases

Compared to the previous year, the number of advertisers releasing new creatives increased by 94.10% in Q3 2023. This resulted in a total of 10.8 million new creatives being released, accounting for 80% of all active creatives. This is a substantial increase from Q3 2022, where new creatives only accounted for 60% of the total.

Advertiser growth

Source: SocialPeta

One notable region driving this growth is Southeast Asia, which ranked first in terms of the average monthly volume of creatives. South Asia and Europe ranked fourth, with an average monthly creatives of 122.

We found that launching creatives during the pre-registration phase was more often seen in more mature markets. Specifically, we observed that incorporating real people in the advertisements yielded the best results.

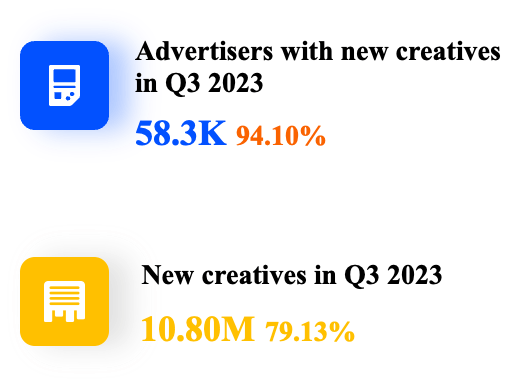

New creatives in Q3 2023

Source: SocialPeta

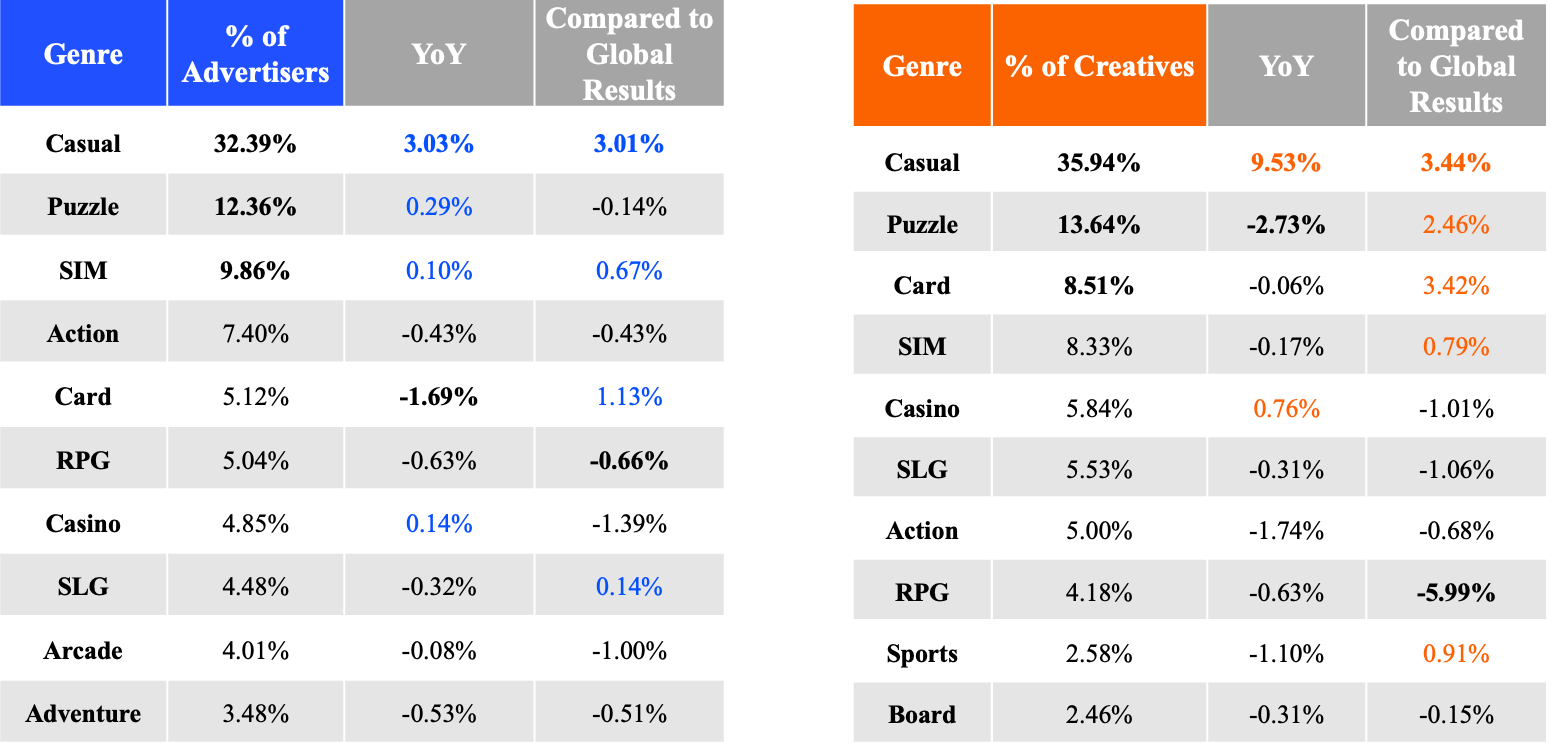

Android dominates advertising with a focus on casual games in India

In India, it was found that the average volume of creatives on Android devices exceeded the global average, while the average volume on iOS devices was below the global average. This indicates that Android is the primary device for advertising mobile games on the Indian market.

Average volume of creatives

Source: SocialPeta

Casual games accounted for the majority of creatives, with a year-on-year increase. RPG ad creatives, however, accounted for a lower percentage compared to the global average.

Genres of creatives

Source: SocialPeta

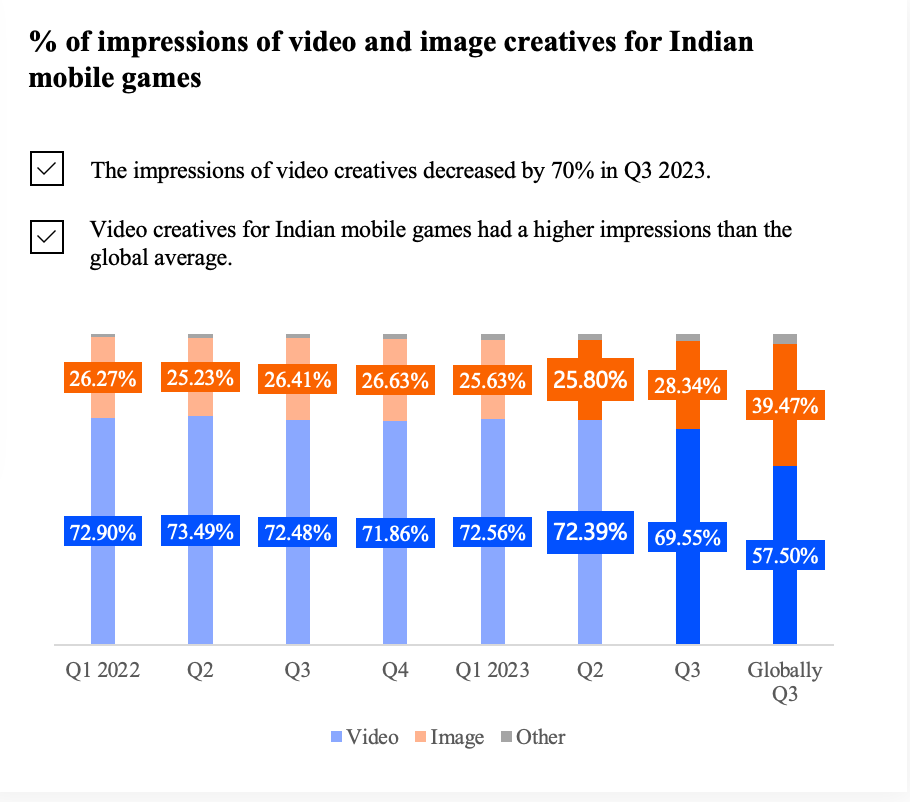

Video creatives appear to have a declining appeal

Videos emerged as the preferred creative format for advertisers in India. However, there was a significant decrease of 70% in average video impressions in Q3 2023, despite videos having a higher impression rate for Indian mobile games compared to the global average. Most video creatives in India were short, lasting 30 seconds or less, while square image creatives were also extensively utilized.

Percentage of creatives for Indian mobile games

Source: SocialPeta

Breaking down marketing strategies of popular game genres in India

For mobile games in India, mini-game creatives proved to be the most effective marketing strategy. Advertisers successfully captured the attention of the audience within the first 3 seconds by utilizing dramatic situations and captivating live-action short videos. Action games, such as MOBA and Battle Royale, were particularly popular due to their combination of socializing and gameplay.

Additionally, the integration of popular cartoons attracted non-core gamers. Cash casino games relied on high cash rewards as their core appeal, with creatives emphasizing continuous wins through exaggerated slogans and live-action dubbing or acting.

To conclude, the Q3 mobile game global market was highlighted by an increasing number of advertisers compared to last year. In the Indian market, advertisers continued showing interest in casual games. Strategies were deployed by advertisers and video creatives were found to have less attraction to Indian players than last year.

To find out more about the marketing trends in Indian mobile games, please download the full report here.