According to App Figures, 60% of the top highest-earning apps use Apple Search Ads. It gives access to relevant and lucrative users with a high retention rate. However, Apple Search Ads holds much more potential than that, including brand protection, product and marketing testing and user insights which are exclusively provided by Apple Search Ads.

This potential can be unlocked if you know exactly how the Apple Search Ads auction algorithms work, why 3-rd party benchmarks aren’t efficient and which key steps you should actually take.

Let’s take a look under the bonnet of Apple Search Ads mechanics and reveal why it has everything to become your #1 user acquisition channel in 2024.

This blog is a cover-up of our talk at App Promotion Summit 2023 held in Berlin. Watch the full video to get more insights on the Apple Search Ads mechanics and growth strategies.

Why Apple Search Ads is the best UA channel

According to Statista, Apple’s ad revenue is believed to grow from $5.6 billion in 2023 to $13.7 billion in 2027, resulting in 83% increase. At Asapty we can see the signs this growth may be even more massive.

This optimistic projection is based on some solid reasons. Apple has an installed base of one billion iPhone users. It is ranked as the #1 source for both volume and value among media in AppsFlyer Performance Index.

Search Ads provides top-quality search traffic. These are highly motivated organic users who are actively searching for apps like yours. And you can reach them with paid acquisition, without worrying about the limitations of Apple’s SKAdNetwork mobile attribution framework.

Apple Search Ads: Challenges or opportunities

While Apple Search Ads offer immense benefits for expanding mobile apps, many marketers surprisingly underutilize and underestimate this promising channel. Those who have tried Apple Search Ads before may walk away unsatisfied with the results, failing to take advantage and spot significant opportunities. The primary reason stems from a lack of understanding of the mechanics, lack an efficient optimization stack as well as translating the results properly. Like any sophisticated platform, success requires thorough knowledge of its inner workings and leveraging the full suite of specialized tools at one’s disposal.

Common challenges frequently assumed by advertisers

Data analytics

The default Search Ads dashboard does not integrate with mobile measurement partners (MMPs), which means you cannot access revenue and in-app events data. To obtain these analytics, you would need to download a large amount of data and manually manipulate spreadsheets. Another option is to create your own custom business intelligence (BI) system. Both options are time-consuming and challenging, but let’s imagine you chose one of these options.

Optimization

Now that your data is organized, you need to monitor and optimize your campaigns on a daily basis. This can be done manually using Search Ads tools, which may work well if your account is relatively small. You can manually manage 20-30 campaigns, but what if you have 1000 campaigns and your goal is to scale up? Using a dedicated Apple Search Ads optimization platform with intelligent algorithms will help to automate, manage and scale the process profitably.

Keyword research

Keyword research is a cornerstone of Apple Search Ads management. One of the great advantages of this ad network is that you don’t need to design creatives for your campaign. All you need to do is find the right keywords and test them. However, this presents another challenge. Keyword research is an ongoing and labor-intensive process. The integrated tool provides around 100 keywords per target country, but your ad strategy may require covering thousands of keywords for each target country. This number multiplies if you are promoting multiple mobile apps.

What you should know about Apple Search Ads mechanics

Equal opportunities for everyone

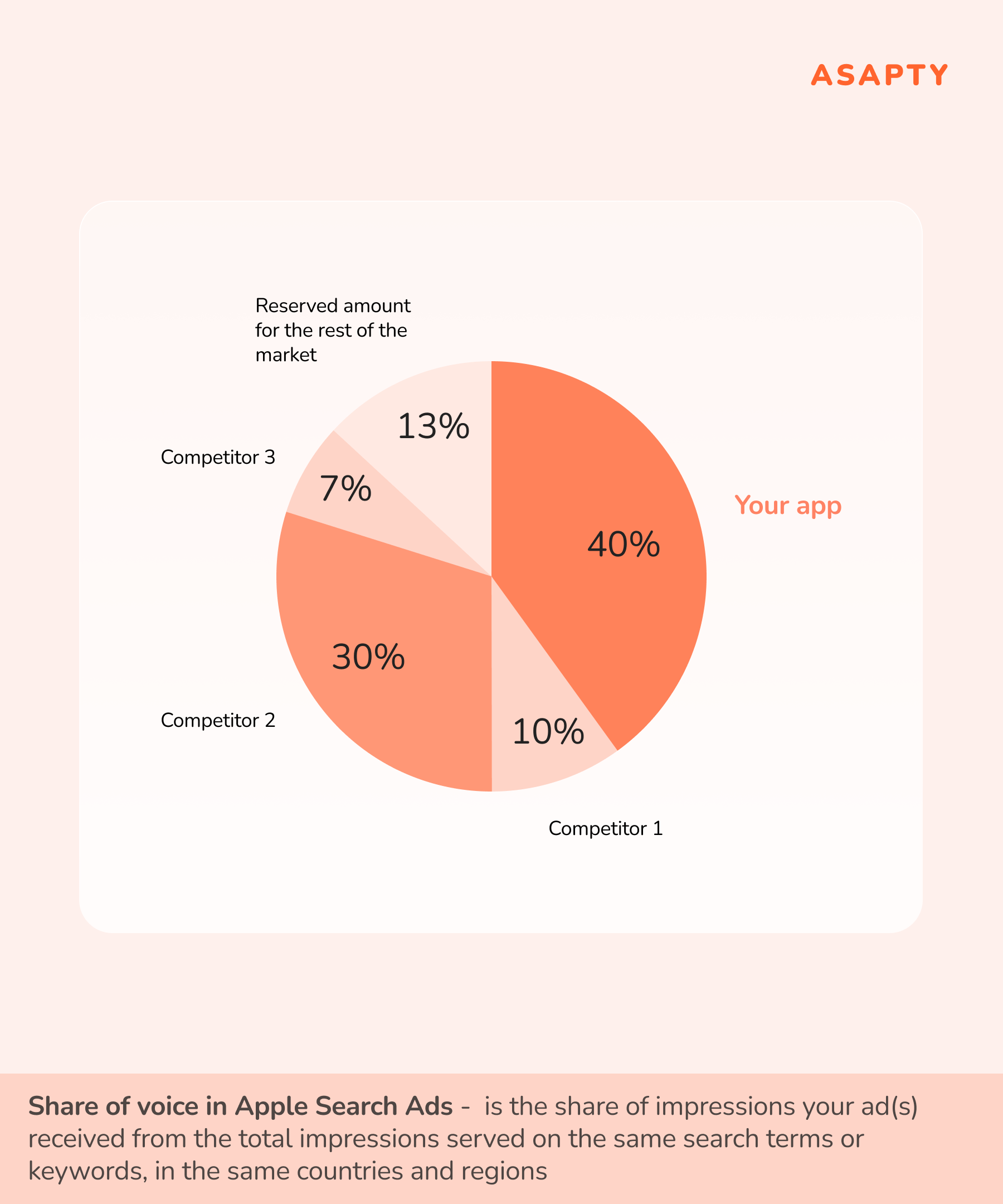

In Apple Search Ads, everyone has a chance to compete. Traffic is distributed among all the competing apps (except for your brand keywords). No app can get 100% share, and every app can enter the competition and get some installs at a low price, even within the most competitive categories. At Asapty, we have observed this phenomenon while working with numerous apps worldwide that bid on the same keywords within the same target country.

Let’s consider a scenario where there are 1000 keywords in your category and target country. Your app can only obtain impressions for a certain percentage, denoted as Y%, of these X keywords. For example, it could be 40% or 400 keywords. The remaining keywords will be allocated to other apps that wish to participate in the auction. Now, the task is to identify and analyze this Y% of specific keywords that have available impression volume for your mobile app to bid on competitively.

Share of impressions received by ads

Source: Asapty

One useful metric to track your positions in the market in Apple Search Ads is Share of Voice. Share of voice refers to the share of impressions your ad(s) received from the total impressions served on the same search terms or keywords, in the same countries and regions.

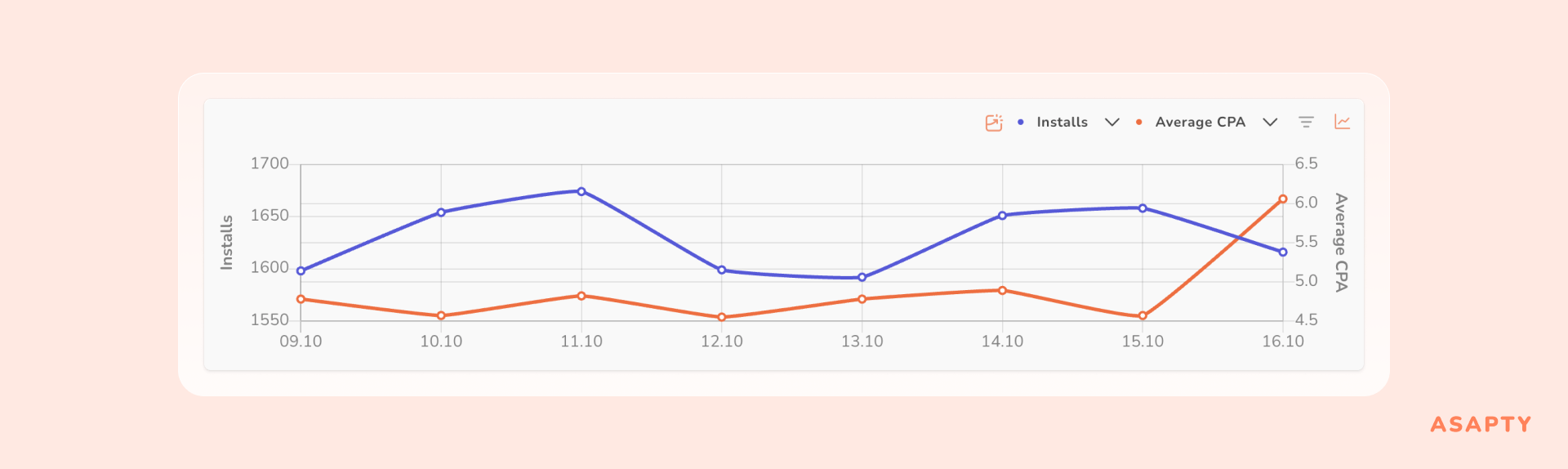

Correlation between bids and impression volume

Increasing the bid does not always guarantee an increase in impression volume. This can be illustrated with the following example: Imagine a situation where a UA manager, who is overwhelmed with tracking hundreds of campaigns, mistakenly raises a bid by $20 instead of 20%. In this case, there is a high chance that the number of installs will not be significantly affected, but your average CPA may increase dramatically.

Bids and impression volume

Source: Asapty

Essentially, this means that you can obtain nearly the same number of installs for both $0.50 and $3. The reason for this lies in the fundamental mechanics of the Apple Search Ads auction, which is not a second-price auction. Therefore, if you place a higher bid than it’s required to set for this specific audience, you will simply pay a higher price for the same number of installs.

Note: In the generalized second-price auction (GSP), bidders place bids and the highest bid wins the first slot. However, the winner pays the amount of the second-highest bid, not their own bid. The second-highest bid wins the second slot and pays the third-highest bid, and so on. Therefore, even though bidding the most secures the best slot, you pay less based on the next lower bid. This auction system encourages competitive bidding while minimizing costs.

Use Search Ads Popularity to optimize bids

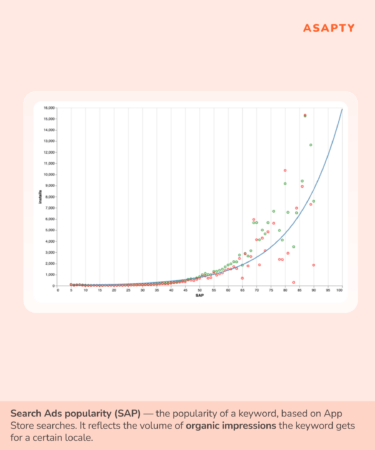

So how to find a proper bid and get the most out of Apple Search Ads? The major task is to estimate your traffic amount and the target audience size. For this purpose, you can use Search Ads Popularity.

Search Ads Popularity (SAP) measures the popularity of a keyword, based on App Store searches. It reflects the volume of organic impressions the keyword gets for a certain locale.

You can discover SAP for every keyword and each target country. The number of impressions on the scale grows exponentially with the rise of the SAP score and thus it varies dramatically the closer the SAP score gets to 100.

SAP – Search Ads Popularity

Source: Asapty

Taking into account that not every organic search result displays Apple Search Ads banner, we can get to an interesting observation. High Search Ads Popularity score doesn’t always ensure high impression volumes. The number featuring paid ads depends on the app category and relevance to a keyword in a target country. Two keywords may have the same Search Ads Popularity score of 40. But for one, an app gets 300 daily impressions with 91-100% impression share. For the other keyword, the app gets 1,000 impressions with the same 91-100% impression share.

In other words, some app categories have high organic search volume but display fewer ads. This creates a paradoxical situation – high Search Ads Popularity (SAP) scores with lower impression volumes. This happens because the number of impressions will be “reserved” for other apps, as we’ve mentioned above.

Why generic third-party benchmarks miss the mark for Apple Search Ads

When managing Apple campaigns, marketers often cling to third-party benchmark data like a crutch. But this generalized data rarely reflects the unique landscape of an app’s niche.

App categories splinter into subcategories like fractured glass. Photo & Video shatters – photo editing, video editing, Instagram visuals editors. And the group of Instagram visual editors itself fractures further into Reels templates, Stories editors, Highlights icons, Layouts, etc. – each slice carrying its own average bid, CPA, CPI, and ROI. Market-level data can’t accurately capture the complexities within each app niche and across shards, these metrics fluctuate wildly.

A benchmark report may show the average CPI for utility apps in the US is $1.86. A marketer might use this to assess performance and set bids. However, subcategories vary greatly. For example, the CPI may be:

- $0.20 for calculator apps

- $0.60 for two-factor authenticator apps

- $2 for password manager apps

- $3.50 for VPN apps

Bidding according to the broad $1.86 utility benchmark could overpay for certain subcategories. A 2FA authenticator app bidding $1.86 would overspend by 3X. Meanwhile, a VPN app at $1.86 may get no impressions at all. With this example, we’d like to illustrate, rather than relying on the broad utility app benchmark, marketers must analyze the unique dynamics within each subcategory.

Best practices on Apple Search Ads account management

Expand the markets

Don’t make the mistake of judging Apple Search Ads’ potential based only on your campaign performance in the US. The common experience is launching in the US, getting frustrated with results, and abandoning Apple Search Ads altogether. But the US is highly competitive with inflated costs. The opportunity lies in other countries where costs per install are lower and competition is less fierce. Apple Search Ads is available in 60 countries providing a wide range of options for expanding your reach. Our data shows most apps see better ROI outside the US once they expand beyond this single market.

Understand the difference in costs for different keywords

Even a slight variation in keywords can lead to significant differences in bids. For instance, the keyword “online video editor” may cost $5, while “fun video editor” may only cost $2.

This discrepancy in costs is likely due to a hidden keyword performance tracking system that takes into account the Average Revenue Per User (ARPU) for each keyword. It recognizes that “online video editor” will yield higher profitability, hence the higher bid for this particular keyword.

Understand how you can overcome your scaling limits

This is a common scenario for many mobile apps. Initially, your results may be satisfactory, but as you reach a certain level, it becomes difficult to make further progress. This also happened to an Asapty customer, a video chatting app that faced challenges in surpassing 20K monthly installs. However, by gaining a deep understanding of the mechanics behind the Apple Search Ads auction and leveraging intelligent optimization algorithms, the app experienced remarkable growth. It achieved a 275% increase in monthly installs, reaching 55K, and reduced the average cost per acquisition (CPA) by 50%, from $5.6 to $3.3, within just one month.

Bottomline

Apple Search Ads has the potential to be the #1 user acquisition channel, offering access to relevant users, brand protection, and valuable user insights. Understanding the auction algorithms, optimizing campaigns, and conducting thorough keyword research are key steps to unlock this potential.

The mechanics of Apple Search Ads ensure equal opportunities for all apps. Use Search Ads popularity and mind understanding the limitations of third-party benchmarks are crucial. Increasing bids in Apple Search Ads does not always guarantee more impressions. To ensure profitable growth, consider expanding to different markets, analyzing costs for different keywords, and using intelligent algorithms.