2023 marked the emergence of short video and AIGC as leading trends in the mobile app landscape. While other sectors experienced a cooling period, short video and AIGC saw rapid growth, attracting a wave of newcomers and becoming focal points within these fields.

However, in the dynamic market environment, merely riding the wave of popularity isn’t sufficient. It’s crucial to deeply understand the needs of target users and develop effective marketing strategies to drive business growth and success.

With this in mind, SocialPeta is pleased to announce the release of the 2023 Global Mobile Application (Non-Game) Marketing Trend White Paper. It aims to provide insights into these rapidly evolving fields and empower individuals to succeed in competitive markets.

Explosive growth in North America

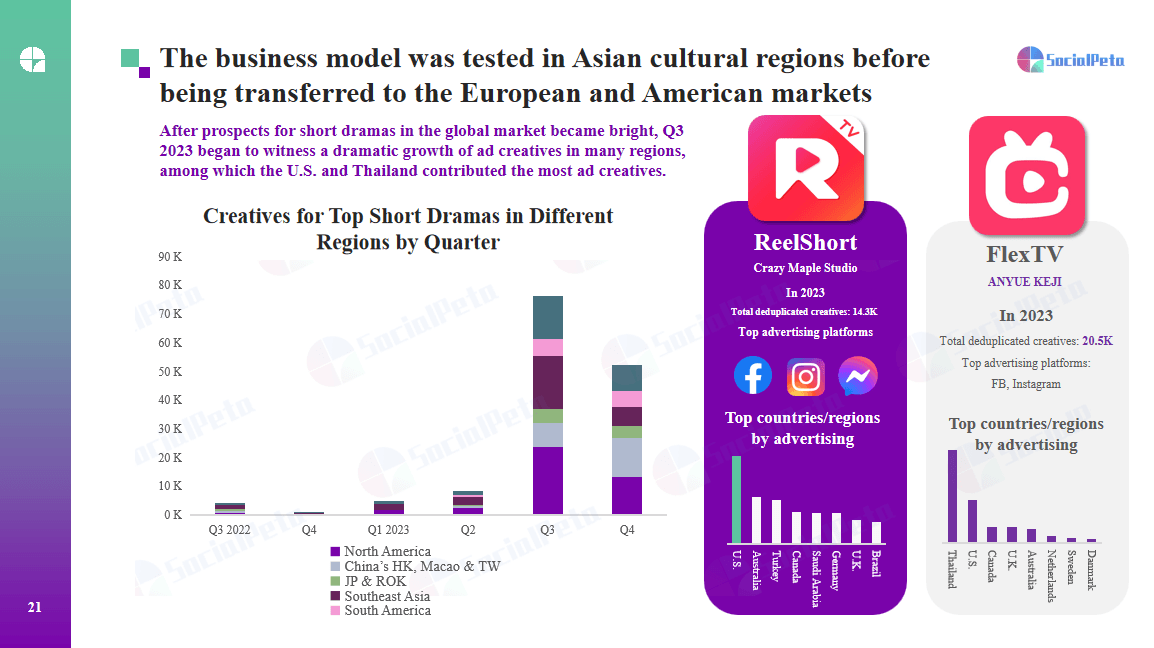

In the section dedicated to key categories, this report particularly focuses on short dramas, a hotly contested sector, and dissects the advertising strategies employed across different time periods and regions. It is observed that, initially, the major short drama apps concentrated their advertising efforts on Asian cultural regions such as Southeast Asia, Japan, Korea, and China’s Hong Kong, Macao, and Taiwan. It was not until Crazy Maple Studi ReelShort emerged prominently in Q3 of 2023 that the short drama apps began to pivot towards Europe and America, initiating a significant advertising campaign.

Creatives for top short dramas in different regions I

Source: SocialPeta

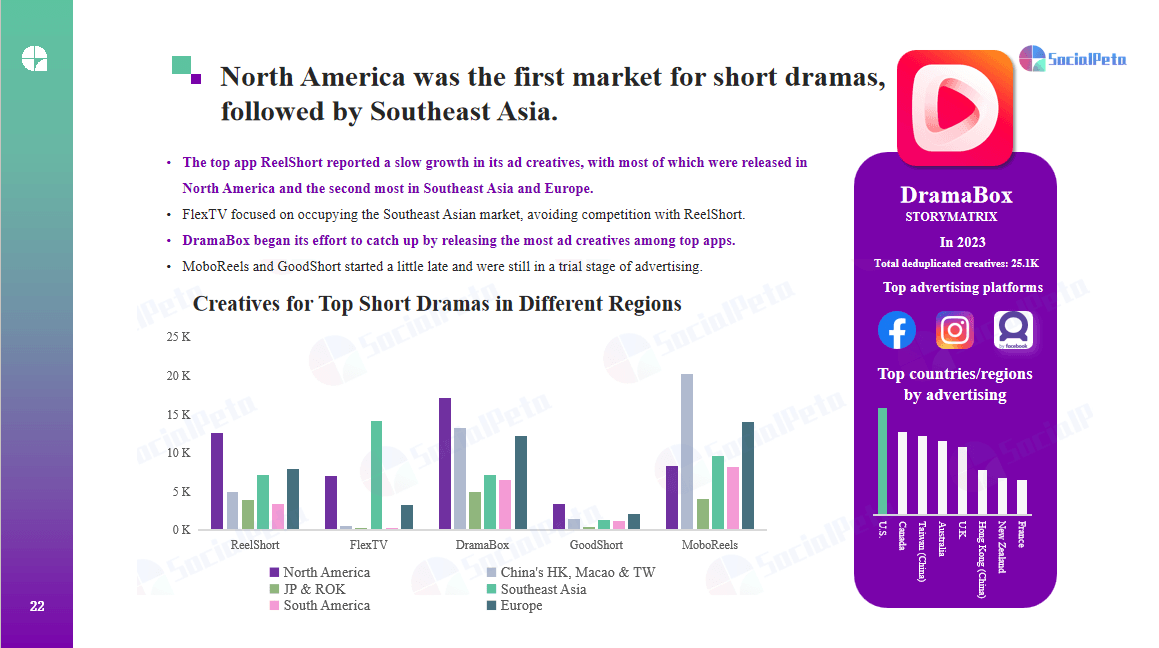

However, based on the data it has observed, although ReelShor, a leader in the short drama market, has a significant amount of advertising, the product that truly goes all out in advertising is “someone else”: DramaBox stands out among all popular short drama products with its high volume of ad placements, effectively covering all popular regions. Flex TV, while slightly less aggressive in its overall advertising efforts, pays special attention to the Southeast Asian market, leading in advertising in that region, which also represents a promising direction.

Creatives for top short dramas in different regions II

Source: SocialPeta

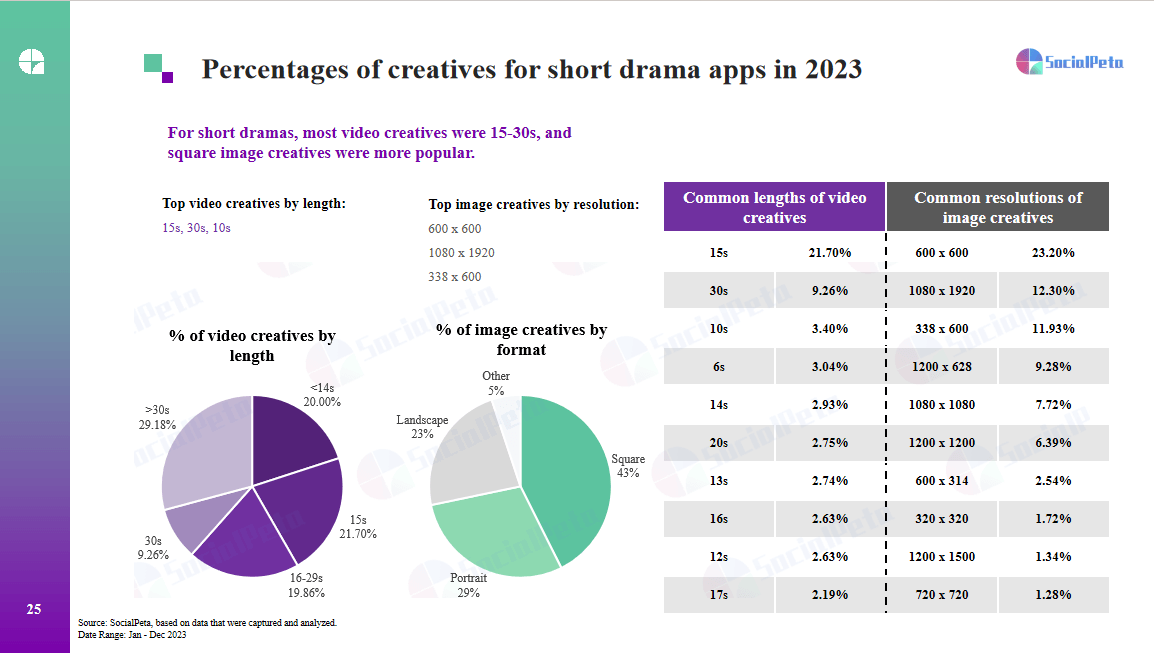

Additionally, we have captured and organized data on the duration of video materials and the resolution of image materials used in advertising for short drama applications. Video materials ranging from 15 to 30 seconds are the primary type used for short drama products, while in terms of images, square image materials are more favoured by advertisers.

% of creatives for short drama apps

Source: SocialPeta

AIGC: Production efficiency upgrade, vertical and niche trends

ChatGPT’s sudden arrival presented a new perspective on AIGC. The AIGC boom in 2023 spurred the development of many competing products. The major challenge faced by those products is how to stand out from the many other brands. Should they rely on advanced technology or successful marketing campaigns? This report has also observed some products that stand out through marketing strategies and buying visibility in creative ways.

Advertising creativity

Source: SocialPeta

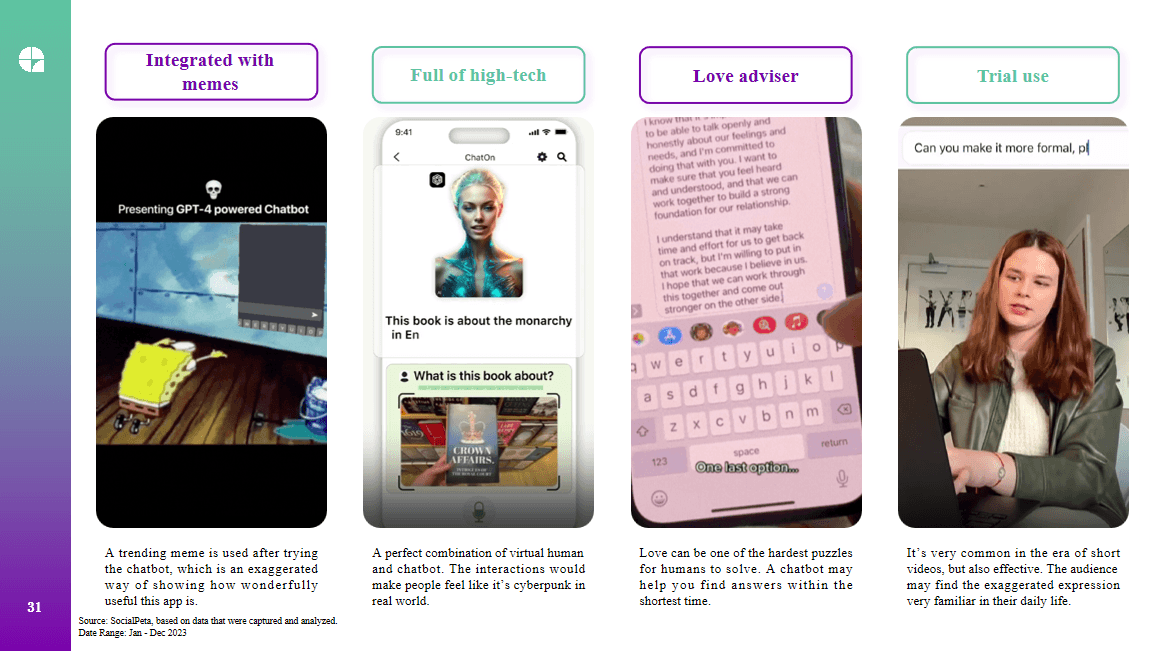

SocialPeta’s advertising creativity section has organized some of the popular creative directions for AI products, which can be broadly categorized into the following:

- A trending meme is used after trying the chatbot, which is an exaggerated way of showing how wonderfully useful this app is.

- A perfect combination of virtual human and chatbot. The interactions would make people feel like it’s cyberpunk in the real world.

- Love can be one of the hardest puzzles for humans to solve. A chatbot may help you find answers within the shortest time.

- It’s very common in the era of short videos, but also effective. The audience may find the exaggerated expression very familiar in their daily life.

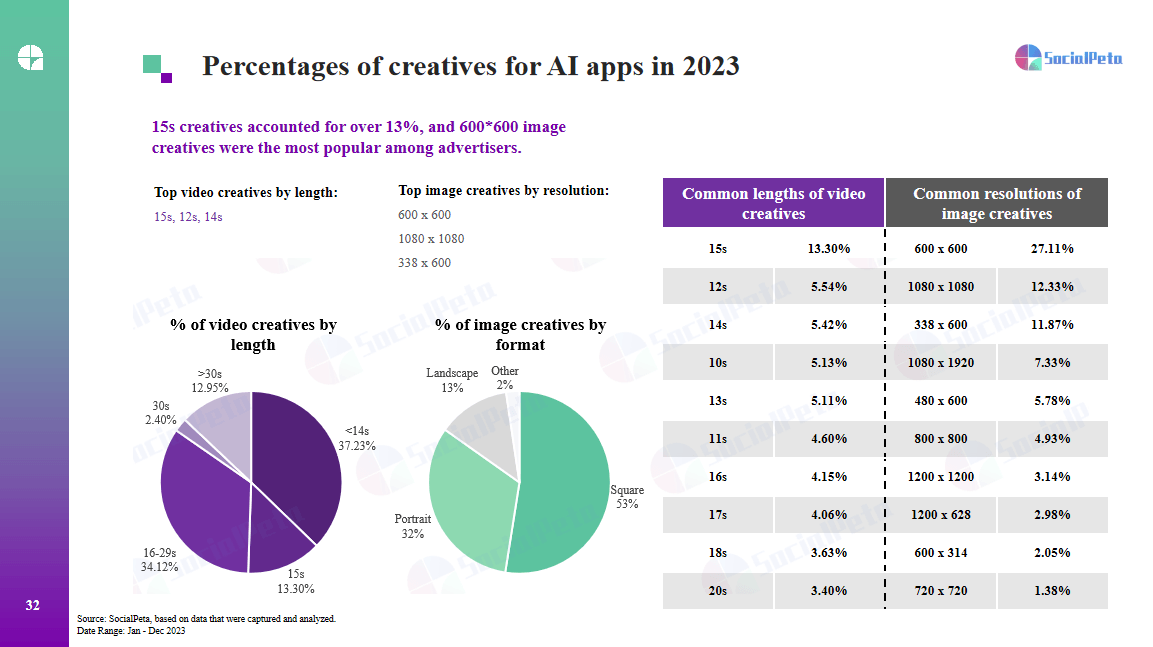

Similarly, it has also organized information on the duration of video creative content and the resolution of image materials for AI applications. 15s creatives accounted for over 13%, and 600*600 image creatives were the most popular among advertisers.

% of creatives for AI apps

Source: SocialPeta

In the final part of the AIGC section, this report also provides a forecast for the development trends in 2024. It believes that current large model apps are quite sufficient for solving daily problems, but they may fall short when it comes to specialized and vertical domains. At the same time, there are a lot of competing products, so it’s smart to focus on an industry segment. This approach could potentially lead to even greater achievements in the future.

Brazil: Android dominates with an 86% market share, entertainment apps generate the highest revenue

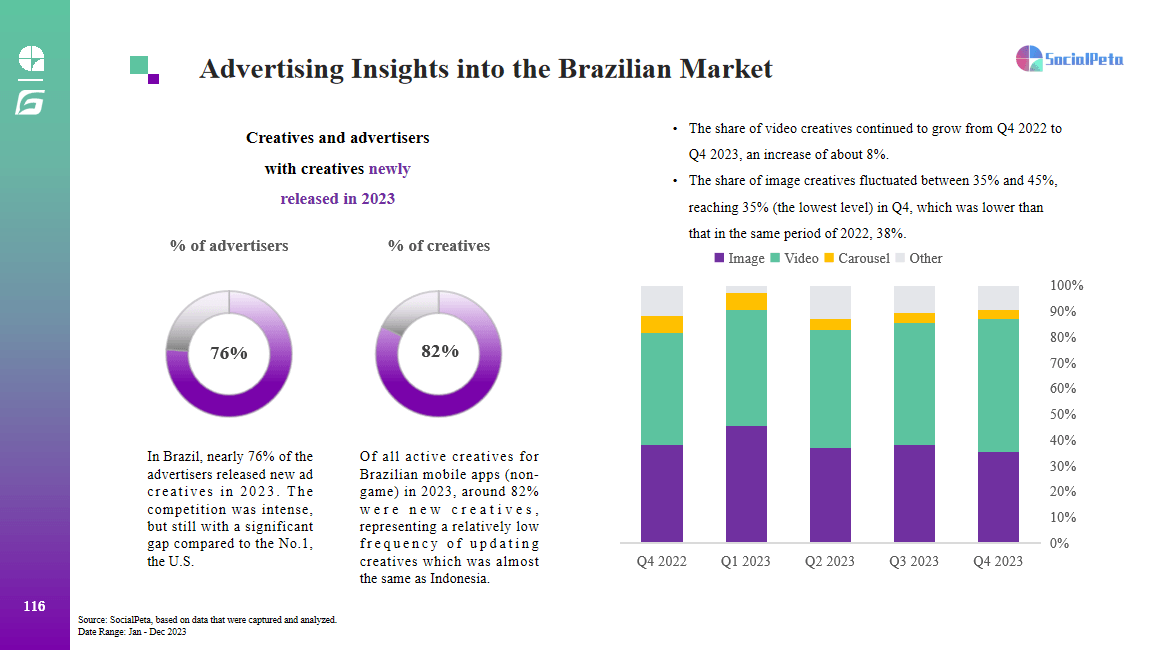

In the regional section, this whitepaper encompasses observations from the United States, Brazil, Indonesia, the Middle East, and China’s Hong Kong and Macao and Taiwan. Let’s first delve into Brazil, Brazil is the fourth largest region globally in terms of mobile app downloads, of all active creatives for Brazilian mobile apps (non-game) in 2023, around 82% were new creatives, representing a relatively low frequency of updating creatives which was almost the same as Indonesia.

Advertising insights into the Brazilian market

Source: SocialPeta

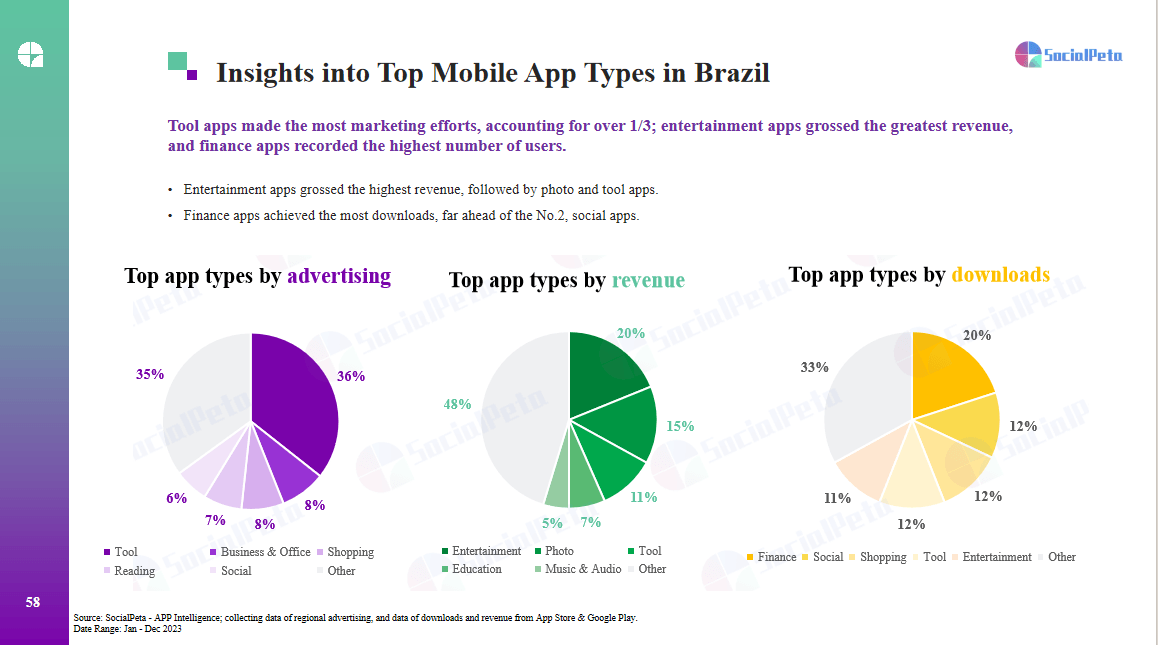

In terms of categories, Tool apps made the most marketing efforts, accounting for over 1/3; entertainment apps grossed the greatest revenue, and finance apps recorded the highest number of users; in terms of revenue, entertainment apps grossed the highest revenue, followed by photo and tool apps, while Finance apps achieved the most downloads, far ahead of the No.2, social apps.

Insights into top mobile types in Brazil

Source: SocialPeta

The comprehensive report spans over 70 pages and delves into various application categories such as short video, AIGC, social, tools, and shopping. It also provides detailed analyses of key regions including the United States, Brazil, Indonesia, the Middle East, and the Hong Kong, Macao and Taiwan Regions.

For deeper insights into mobile app marketing trends, download the full report to gain a better understanding of the evolving landscape and devise more effective marketing strategies.