Recent events have laid bare the world’s reliance on digital. With billions under quarantine, people and businesses alike have relied on digital to connect with loved ones, customers, work remotely, get the news, and stay entertained.

The article was first published on AdLibertas blog.

For tech companies, the long-term outcome remains to be seen, but some immediate shifts are readily apparent. Netflix, Zoom, Amazon, food and grocery delivery have all seen crushing demand; the Uber and Airbnb unicorns are suffering. Amidst the chaos, esteemed investment firm Sequoia offered counsel to its portfolio companies, which is sound advice for any tech investor or startup.

But lost in much of this tech discussion are app developers, the silent picks-and-axes of this enormous digital shift and the unsung critical link for consumers and businesses alike. There are expected to be 7 billion mobile users by 2021, with total annual mobile app downloads reaching 258 billion by 2022. Mobile users are spending 87% of their time in apps, versus just 13% on the web, according to Comscore.

With so much consumer reliance on mobile apps and so much money in the ecosystem, it’s easy to hope app developers will be shielded from any major upheaval in the world’s economy.

The reality couldn’t be further from the truth. Regardless of the short-term increasing usage of digital communication and entertainment while users are stuck at home, there’s an economic downturn coming, and that means there’s a winter coming for app developers everywhere.

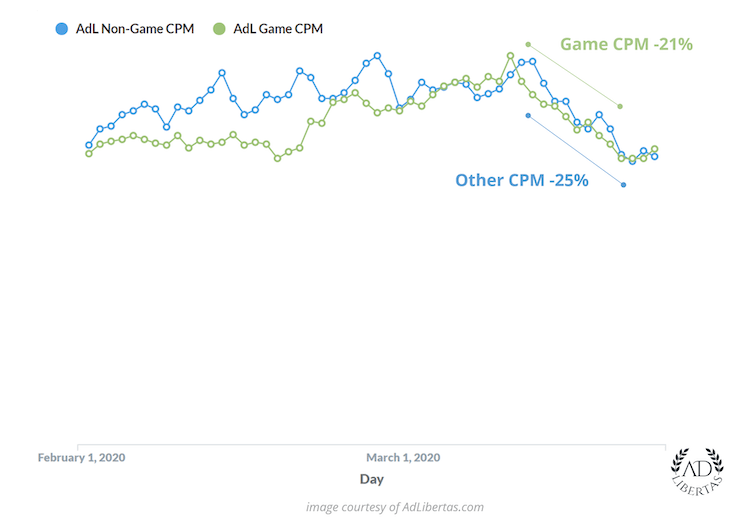

“We’ve seen a big decrease in advertising rates across the board. The hardest hit are networks boasting brand-dollars…significantly down in overall spend, leading to aggregated lower rates.”

The bad news

This is uncharted territory for mobile apps. Since mainstream emergence in 2010, the mobile app market hasn’t experienced a significant market downturn. Most app developers survive by earning money from consumer in-app purchases (IAP) and advertising and a down economy will drastically affect both revenue streams.

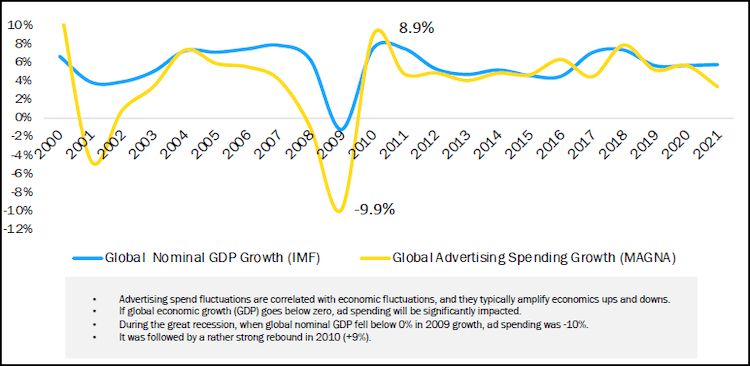

Consumers tighten their spending in downtimes — that’s a long-established reality. Likewise, advertising doesn’t respond well to recessions. Following the 2008 market crash, overall ad spend dropped 13%. As marketing expert Samuel Scott wrote in The Drum last year, “Ad agency revenue growth is historically a lagging indicator for GDP — meaning that any change in economic growth hits agencies a few quarters later.”

Those are the core issues for app developers. As consumers curtail their discretionary spending, in-app purchases and subscriptions will likely be impacted, creating lower user-values. In simplest terms, users will be less likely to subscribe or opt-in for in-app purchases when they’re hurting financially at home.

As consumers get frugal, ad budgets will tighten. This makes sense: advertising is all about growth, and when times are good, money flows to ads; when capital expenditures contract, advertising is (wrongly, some say) the first place cuts are made — so in-app ads will generate less revenue for app developers. We’re already seeing a decrease in ad rates overall caused by shrinking ad budgets. For over 100 years, we’ve seen ad budgets parallel overall market conditions — up and down — followed closely in 30/60/90 day cycles.

Like any market, a decrease in competition leads to a lowering of prices. As advertising spend decreases, competitive pressure on the market relaxes, allowing the remaining buyers to buy more for less. Long term economics dictate a relaxation of competitive pressure that will allow buyers to reduce prices, creating a vicious cycle of continually lowered rates.

Performance marketers are shifting budgets to Browser Advertising 📈

Learn how brands like Walmart, Expedia and Nike drive incremental growth by reaching high-intent users before they hit search.

Get Your Free GuideConsumer app usage should be yet another consideration for app developers. Sure, usage is largely up for some app traffic at the moment, as people work from home, entertain themselves, and reach out via video calls and messaging. While the internet backbone has sagged under the weight of this surge, app usage has soared exponentially.

But this increased usage is only temporary — and, even more devastating, it’s masking bad news. In short, there are more eyeballs in apps, but behind this surge of activity are falling ad rates. As normal life returns and people get back to their lives, app developers will see traffic fall and — coupled with lowered advertising spend — app developers will be stuck with the lingering, crushing reality of vastly affected revenues.

The good news

Esteemed banker and politician Sir Nathan Rothschild once advised, “Buy when there’s blood in the streets … even if the blood is your own.” That’s sage advice for any businessperson, and app developers are no different. There are a few silver linings to a down economy, and those with the liquidity (and the stomach) to invest stand to make major gains when the market recovers.

With over 5 million apps, the app market has become a tremendously crowded, competitive space. The good news is, it’s still growing. This year, mobile apps are projected to earn $188 billion. We will likely see the creation — or, in some cases, the solidification — of some superpower app developers who are in a position to take advantage of a down economy. But even small indie developers can thrive, if they know where to look.

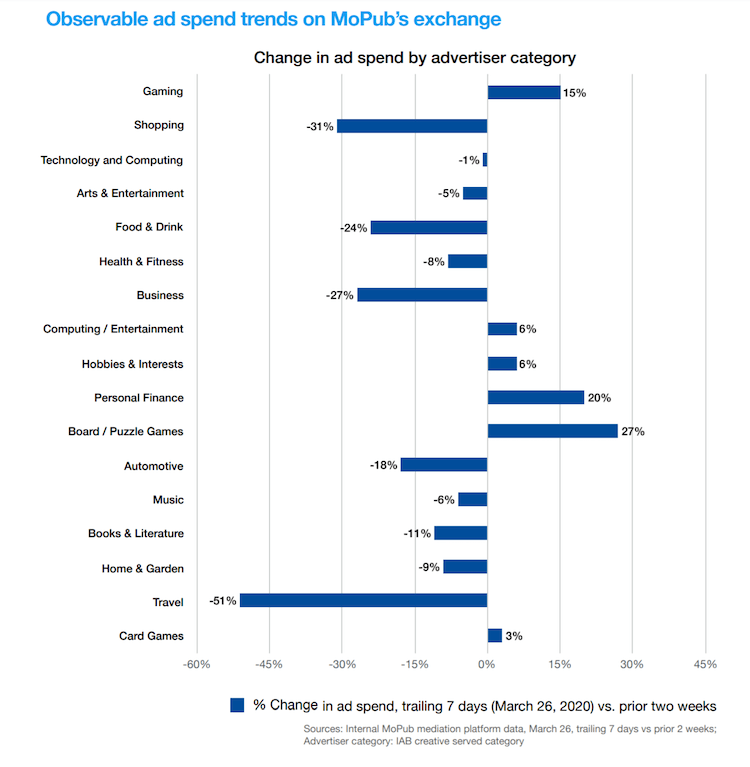

“It’s clear that certain advertising verticals have withdrawn or ramped down budgets….A growing mobile user base and an increase in time spent in-app means a larger potential audience for app developers.”

For one, growing your audience will be cheaper. App developers across the board will be able to be more competitive in the investment of users during this economic pullback. Achieving user-growth will become cheaper, and apps — especially those that boast long user retention, or life-time value (LTV) — can bet on “traffic futures,” buying traffic and eyeballs at a price that wouldn’t have been possible a month ago — because those prices may be impossibly low in the months to come.

Further, growing your portfolio might be cheaper, too. There’s a reason mergers generally soar in any industry during a down market. Competitors or contemporaries might become tempting acquisition targets, whether for their users, team, or brand. Less-prepared developers, or those operating on soon-to-be-scarce outside funding, may find a lifeline, partnership, or acquisition a very interesting growth proposition.

Fewer dollars also mean many developers will thin ranks, dial back new projects, slow growth, and instead focus on simply maintaining their current app portfolios. A savvy (and contrarian) developer willing to invest in new titles will see far less competition: The charts will be less crowded with new releases, and there will be a huge opportunity to be the next hit title.

Finally, engineering talent will become more available. For the last decade, iOS and Android engineers have been a scarce (and expensive) commodity. As revenue drops, venture capital dries up, competitors fold, and projects get shelved, most companies will freeze or slow hiring. As a result, the job market will flood with talent that was once too expensive or otherwise unavailable. The engineer who last month wanted to start his or her own app might be much more inclined to instead join your team.

Conclusion

Like the impact of the virus, government mandates, the financial market, and the global economy are all still in a period of intense volatility. As is true in any industry, app developers will need to adapt or suffer. App developers will need to closely monitor their position in the market, hoping for the best, planning for the worst, and being bold about seizing the opportunities that present themselves.

The road ahead will be bumpy. But as we enter an increasingly likely period of declining economic growth, it’s important to remember that some of the world’s biggest, strongest businesses were built during economic downturns.